Capital markets regulator Sebi on Tuesday tweaked the offer for sale (OFS) framework to provide more flexibility to promoters and large shareholders planning to sell their shares through the mechanism.

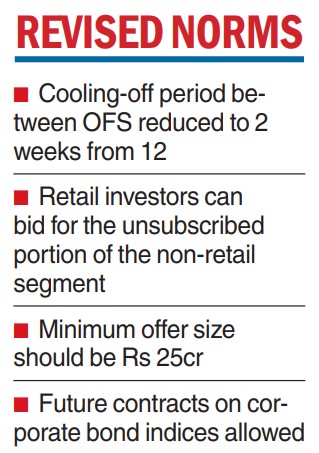

Under the revised framework, the cooling-off period required between two OFS has been reduced to two weeks from 12 weeks.

Besides, retail investors have been allowed to bid for the unsubscribed portion of the non-retail segment, and unit holders of listed real estate investment Trusts (REITs) and infrastructure investment trusts (InvITs) have been allowed to offer their holdings through the OFS mechanism.

The new framework will apply from February 10.

In a circular, Sebi said the minimum offer size should be at least Rs 25 crore for selling shares through the OFS mechanism by shareholders.

The offer size can be less than Rs 25 crore for promoter(s) or promoter group entities so as to achieve minimum public shareholding in a single tranche.

With regard to the cooling-off period, Sebi said the existing period of 12 weeks for OFS has been reduced to a range of two weeks to 12 weeks based on the liquidity of securities of such eligible companies.

In allocation, a minimum of 25 per cent of shares would be reserved for mutual funds and insurance companies; at least 10 per cent would be kept for retail investors.

Bond index futures

In order to enhance liquidity in the bond market and to provide opportunity to the investors to hedge their positions, Sebi on Tuesday allowed stock exchanges to launch future contracts on corporate bond indices.

The index should be composed of corporate debt securities, constituents of the index should have adequate liquidity and diversification at issuer level and the constituents of the index should be periodically reviewed.

Further, a single issuer should not have more than 15 per cent weight in the index, and there should be at least eight issuers. The index should not have more than 25 per cent weight in a particular group of issuers.