The alcobev industry and legal observers want the GST Council to take a time-bound decision and issue a clarification on the taxability of extra neutral alcohol (ENA), a key ingredient used not just in the manufacture of potable liquor but also for industrial and commercial purposes.

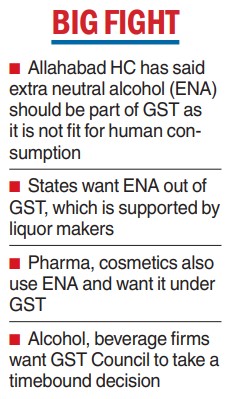

The Allahabad High Court, in the case of Jain Distillery, held ENA is not covered under ‘‘alcoholic liquor for human consumption’’ and is subject to GST.

With the issue already under debate, the observation of the judiciary has made the situation murky.

The decision has opened a floodgate of questions for the manufacturers/suppliers of ENA across the country, who have been paying VAT/CST on the sale, and also the buyers, who have been availing credits of such VAT and setting it off against VAT payable on the sale of alcoholic beverages, Grant Thornton Bharat LLP said in a note.

The taxability of ENA has been the subject matter of deliberation since the 20th GST Council meeting in 2017. Even in the 43rd council meeting in 2021, the matter was deferred and no official clarification was issued in this regard.

Many states have given their views to the GST Council on ENA.

Bengal for instance has said the tax on potable liquor whose raw material comes from ENA must remain with the states; the ENA used for industrial purposes comes under GST, it said.

Uttar Pradesh, where alcohol makes up more than 95 per cent of ENA, has said it should be kept out of GST.

Kerala, Rajasthan, Telangana, Punjab, Madhya Pradesh, Chhattisgarh, Karnataka and a few other states have also said in the GST Council that ENA should be kept out of GST.

Tamil Nadu, a net importer of ENA, stands to lose out if the raw material was kept out of GST. But it has also sided with other states.

“If at all GST is imposed, it will come at 18 per cent whereas the average rate of VAT is around 2 per cent. The 18 per cent additional cost will either have to be borne by the industry or the consumer, neither of which is optimal,” said Vinod Giri, director-general, of the Confederation of Indian Alcoholic Beverages.

“Needless to say, the legal precedences under the erstwhile regime and the recent ruling of the Allahabad High Court would merit consideration as currently, the liquor industry seeks to continue the levy of VAT/CST on ENA, while on the other hand pharmaceuticals, cosmetics and other industries are demanding for inclusion of ENA in the GST net.

"Accordingly, it is important that the government should issue an official clarification, considering the judicial outcome based on the application of ENA to resolve the ambiguity and avoid undesirable litigations,” said legal experts at Grant Thornton Bharat LLP