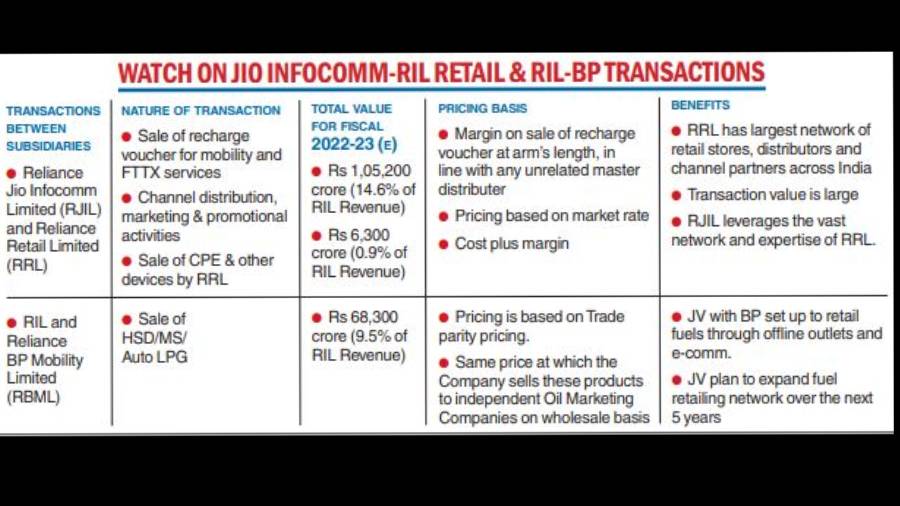

Shareholders of Reliance Industries Ltd (RIL) will get to vote next Monday on a stack of related party transactions within the group. Expect them to be gobsmacked by the size and scale of a transaction between Reliance Jio and Reliance Retail Ltd – both subsidiaries of RIL.

The value of the deal: an eye-popping Rs 1,05,200 crore in the financial year 2022-23. This will probably rank as the largest related party deal that India Inc has ever seen. For the first time, shareholders at RIL will get to vote on the transaction.

Until now, these were never placed before shareholders. But since April 1 this year, market regulator SEBI has mandated that all listed entities will have to seek shareholder approval for any material RPTs. The regulator has been pushing for greater disclosures in one of the most opaque areas of intra-corporate transactions.

A material RPT is classified as a transaction that is valued at either over Rs 1000 crore or 10 per cent of the annual consolidated turnover of the company in a financial year as per its last audited financial statement. Transactions approved before April 1 but continuing after this date will also need their clearance.

A related party with respect to a company could refer to a director or key managerial personnel, a firm in which the director is the partner, subsidiary or associate company of the listed firm.

This deal between Reliance Jio and Reliance Retail will work out to 14.6 per cent of RIL’s annual consolidated turnover for 2021- 22. It also works out to 136.7 per cent of the annual turnover of Reliance Jio as well as 62.1 per cent of the annual turnover of Reliance Retail in 2021-22.

For each of the four subsequent financial years from 2023-24, this is estimated to increase to Rs 2,10,800 crore. The transaction arises from the fact that Reliance Retail is the master distributor for RJIL’s telecom services and Jio is piggybacking on Reliance Retail’s extensive network of stores in the country.

Under the arrangement, RJIL sells recharge vouchers for its mobility and fibre services to RRL on a principal-to-principal basis. It also involves the sale of customer premises equipment, enterprise devices and other devices by Reliance Retail to Reliance Jio.

The note says Reliance Retail charges cost plus margin for the sale of these devices and equipment. Sources said a principal-to-principal basis means that the transaction is between RJIL and RRL and there are no parties in between them. RRL subsequently sells these recharge vouchers to distributors, and markets its online, through its stores and other channels. Reliance Retail had 15,196 stores during the year ended March 31, 2022.

Of this, the number of Reliance Digital outlets stood at over 500. Reliance said the sale prices of recharge vouchers by RJIL to RRL are fixed in such a manner that the margin earned by RRL as master distributor is the same or comparable to the margin that is paid to any other distributor of RJIL.

Sources added that while Reliance Retail sells sim cards and Jio phones, the normal recharges which are available at third party outlets is also distributed by RRL.

RIL added that the agreements between RJIL and RRL for these transactions have been subject to due diligence by the investors in Reliance Retail Ventures and investors in Jio Platforms (the holding company and RIL’s subsidiary for digital services) including Facebook and Google.

Reacting to RIL’s disclosure, analysts at JP Morgan said in a report that the key details on the transactions between the various subsidiaries of RIL (Jio, Retail, Reliance Property) is a positive.

“While it is too early to say if the increased disclosures on the large transactions between the subsidiaries are a step on the road to the listing of these businesses, it would be seen as a positive,” they added.

RIL justified the transaction between RJIL and RRL saying that it is cost-effective to share the network of retail stores, distributors and channel partners of the latter for RJIL’s services and such an arrangement would benefit the company as well as RJIL and RRL. The other major related party transaction pertains to Reliance BP Mobility Ltd(RBML) in which RIL holds51 per cent and the rest is with BP.

The joint venture sells petroleum products to retail consumers through offline retail outlets and e-commerce. RIL estimates that the monetary value for sale of petroleum products to RBML and allied transactions for2022-23 at Rs 68,300 crore. In each of the four financial years till 2026-27, it will workout to Rs 1,33,900 crore.