Reliance Industries has set its sights on roping in investors for its fibre undertaking even as it moves to consummate the tower assets deal with Brookfield in the near term.

This was indicated by its top management after the announcement of the company’s third quarter numbers.

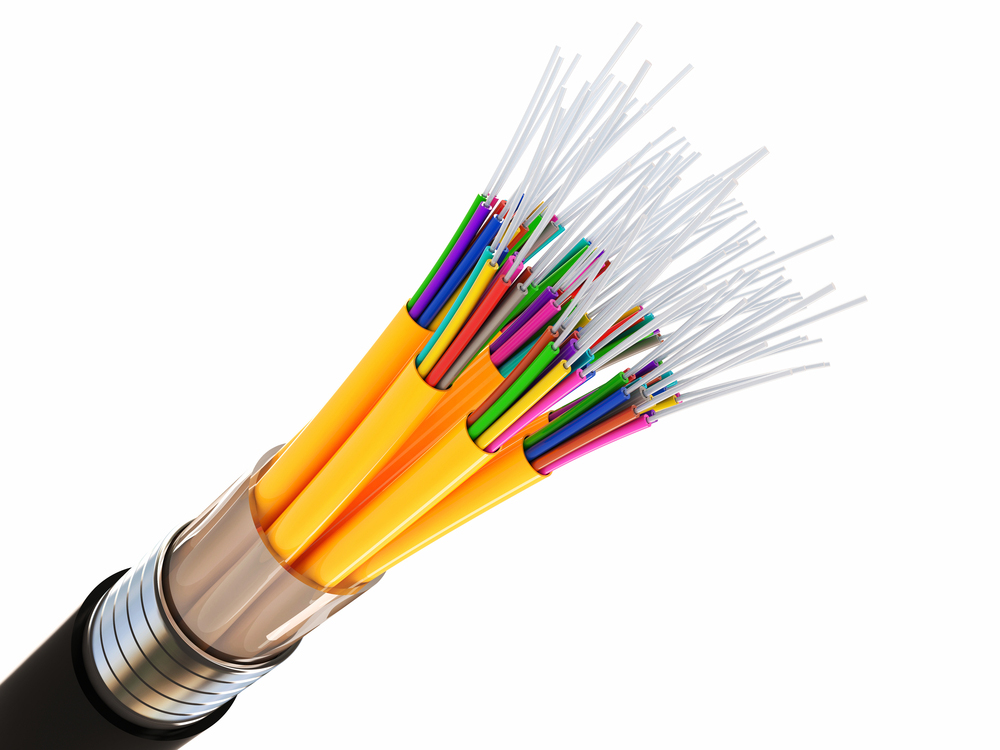

It may be recalled that Reliance Jio had earlier transferred the control of its optical fibre and tower undertakings to two Sebi registered infrastructure Investment Trusts (InvITs).

Last month, Canada’s Brookfield Infrastructure Partners (Brookfield Infrastructure) had announced that it is acquiring 100 per cent stake in the telecom tower arm along with other partners.

While the total equity requirement will be $3.7 billion, Brookfield Infrastructure will invest around $375 million, with the balance being funded by its institutional partners.

The fair trade regulator CCI has approved the divestment of the telecom tower assets to Brookfield and other investors, which include British Columbia Investment Management Corporation and GIC Infra Holdings Pte Ltd’s subsidiaries — Anahera Investment Pte Ltd and Valkyrie Investment Pte Ltd.

In a tweet on Monday, the regulator said it “approves subscription of the units of Tower Infrastructure Trust by BIF IV Jarvis India Pte, British Columbia Investment Management and GIC Investors”.

While the tower InvIT deal is expected to get closed shortly, the management hinted that it is in discussions with investors regarding terms for the fibre InvIT transaction.