Tata Consultancy Services (TCS) on Tuesday offered a mixed start to the earnings season when it reported a 10.8 per cent rise in net profits which came above expectations, but disappointed on the revenue growth front.

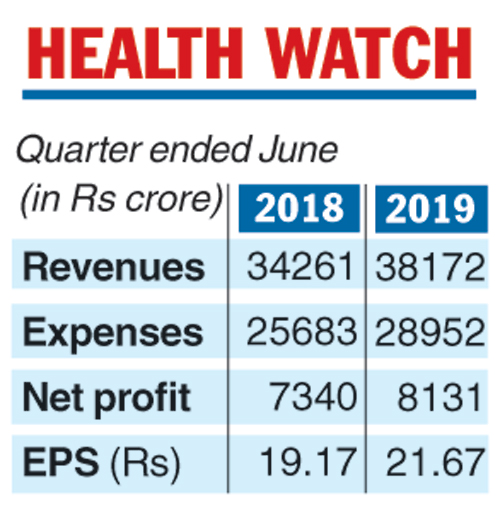

The country’s largest IT services firm posted a net profit of Rs 8,131 crore compared with Rs 7,340 crore in the corresponding previous period.

Analysts were expecting TCS to report net profits in the region of Rs 7,800 crore.

However, the company trailed on the dollar revenue front as it clocked $5,485 million compared with $5051 million in the year-ago period.

Brokerages such as Reliance Securities were expecting TCS to post dollar revenues of around $5532 million. In rupee terms, the revenues came in at Rs 38,172 crore compared with Rs 34,261 crore a year ago. However, in constant currency terms, the revenue growth was lower at 10.6 per cent compared with 12.7 per cent in the preceding three months.

Operating margins were in line with Street estimates as it stood at 24.2 per cent compared with 25.1 per cent in the fourth quarter of 2018-19.

The Telegraph

One of the factors that led to TCS missing estimates on the revenue front was the relatively subdued performance of the banking, financial services & insurance verticals, which is a key customer segment for the company.

TCS is one of the largest providers of BFSI services globally. The growth in BFSI came in at 9.2 per cent compared with 11.6 per cent in the previous three-month period.

Speaking to reporters on Tuesday, Rajesh Gopinathan, CEO of TCS, said the company has started the year on a positive note and that it generated over Rs 75,000 crore in free cash flow during the quarter.

He added that TCS also witnessed good growth across various industries and geographies coupled with a positive trend in client addition. Digital services continued to be the growth driver and it now accounts for 32 per cent of its revenues. This segment showed a growth of 42 per cent over the same period last year.

“We have had a steady start to the new fiscal year. We see customers continuing to spend on their growth and transformation initiatives, and that is showing in our strong order book and deal pipeline this quarter,’’ he said.

During the quarter, life sciences & healthcare grew 18.1 per cent. TCS added that the other verticals which included retail (7.9 per cent), communications & media (8.4 per cent) and manufacturing (5.5 per cent) all showed industry-leading growth rates. In terms of geographies, the growth was led by the UK (16 per cent), India (15.9 per cent) and Europe at over 15 per cent.

While the results came after market hours, the TCS scrip ended with losses of 2.05 per cent at Rs 2,131.45 on the BSE.