The Reserve Bank of India (RBI) will come up with revised norms on the resolution of stressed assets after the Supreme Court on Tuesday struck down the apex bank’s February 12, 2018 circular, even as it pointed out the judgement does not curb its powers to prescribe solutions to tackle bad debt.

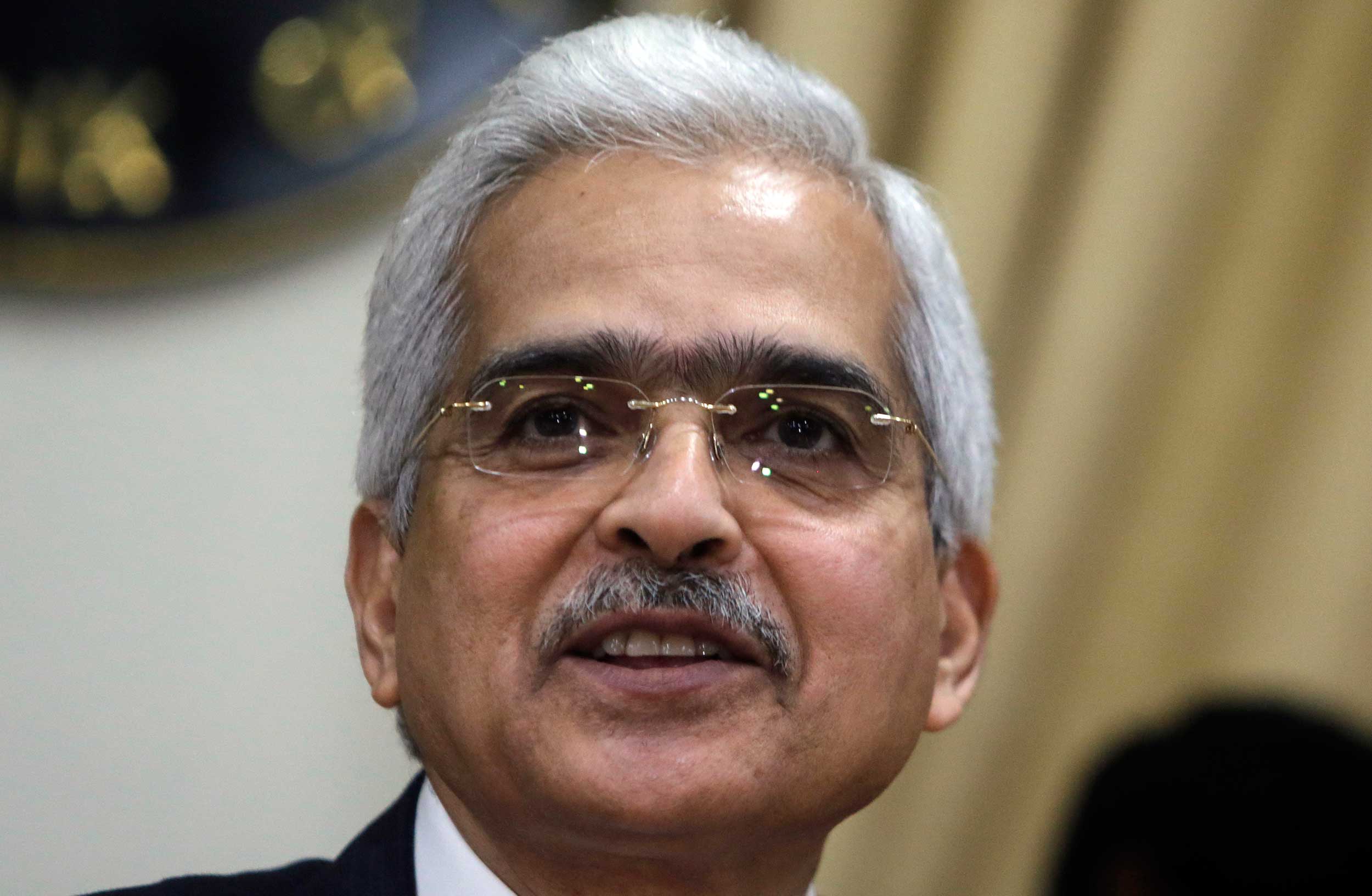

In his first interaction with the press since the order of the apex court, RBI governor Shaktikanta Das said the central bank remained committed to not only maintain but also speed up and enhance the momentum of resolution of stressed assets.

“The Supreme Court order has not taken away any powers from the RBI. The powers are still vested with the RBI but has to be exercised in a particular manner. We will exercise the powers which Parliament has given to us and see that the resolution is done fast… there will not be any undue delay (in bringing a new circular),” Das told reporters after the meeting of the monetary policy committee on Thursday.

Das explained that Section 35AA of the amended Banking Regulation Act had been upheld by the Supreme Court. He said the section states the RBI will have to exercise its powers “in respect of specific defaults by specific debtors”.

He said the apex court had found the circular as ultra vires (acting beyond one’s legal power or authority) for being implemented for all large “debtors generally”.

“What basically the SC has said is that the powers of the RBI under Section 35AA have to be exercised in a particular manner but the validity of the Section 35AA stands,” he noted.

On Tuesday, a two-judge bench of the apex court, comprising Rohinton Nariman and Vineet Saran, had declared the February 12 circular of the RBI as ultra vires.

The circular said even if there was a default by a day, banks would have to initiate a resolution process which had to be completed within 180 days. If a plan was not finalised by this time, the lenders must refer all accounts with loans of over Rs 2,000 crore to the NCLT.

Responding to a query on recent instances of the RBI being taken to court, Das said it was the democratic right of any person, individual or corporate entity to challenge the decision of any authority.

The RBI, on its part, takes decisions after consulting multiple stakeholders. It puts discussion papers on its website to get the views of the public, Das said. However, in some cases this cannot be done.