SBI group chief economic advisor Soumya Kanti Ghosh on Friday said inflation in February, to be released Monday, could be at a similar level to that of January at 6.5 per cent, leading to another round of rate hike by the Reserve Bank of India in April.

“February inflation number could actually reflect a similar number of 6.5 per cent,” Ghosh said at a Bharat Chamber of Commerce-organised session.

In January, India’s retail inflation rose to 6.52 per cent on costly food items and fuel. With this, inflation breached the RBI’s upper tolerance limit of 6 per cent after remaining under it in the previous two months.

In December, the consumer price index (CPI)-based inflation had eased to 5.72 per cent. In November, it had fallen to 5.88 per cent. The retail inflation came under the RBI’s 2-6 per cent band in November with 5.88 per cent rate after remaining beyond it for 10 months consecutively.

According to a Reuters poll, the retail inflation is likely to have eased a bit last month but has stayed above the RBI’s upper threshold keeping the central bank on course for further policy tightening.

The March 2-9 Reuters poll of 43 economists showed CPI inflation likely fell to 6.35 per cent in February from 6.52 per cent in January. Forecasts ranged from 5.89 per cent to 6.70 per cent for the data.

Rapid hike

Ghosh pointed to the rapid pace of policy hikes by the RBI and said there was a need to debate whether to follow the trend of mirroring the US Federal Reserve in raising rates.

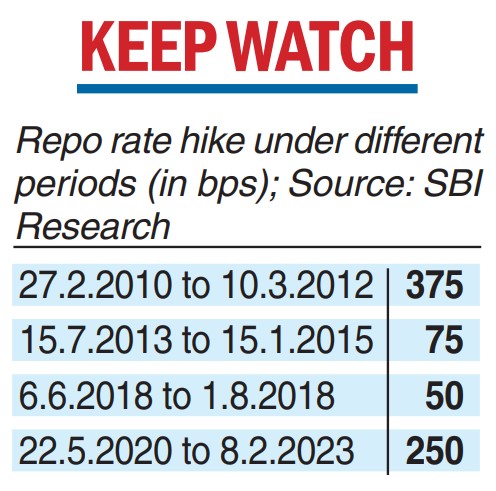

He said that in 2010, when D. Subbarao was the RBI governor, the central bank had raised rates by 375 basis points over 14 monetary policies. But in this cycle, there has already been a 250 basis point increase in policy rates over six monetary policies and it is still ongoing. (see chart).

While supporting the central bank’s move to frontload the rate hike, Ghosh said that the speed of tightening is a matter of worry.

“At some point of time we just need to pause and see whether the impact of the earlier rate hikes have percolated down. I don’t see any end to the Fed rate hike cycle soon. We need to decipher our pace of action and whether we need to decouple it from the Fed or we need to keep pace with them. This is something to debate at some point of time,” he said.