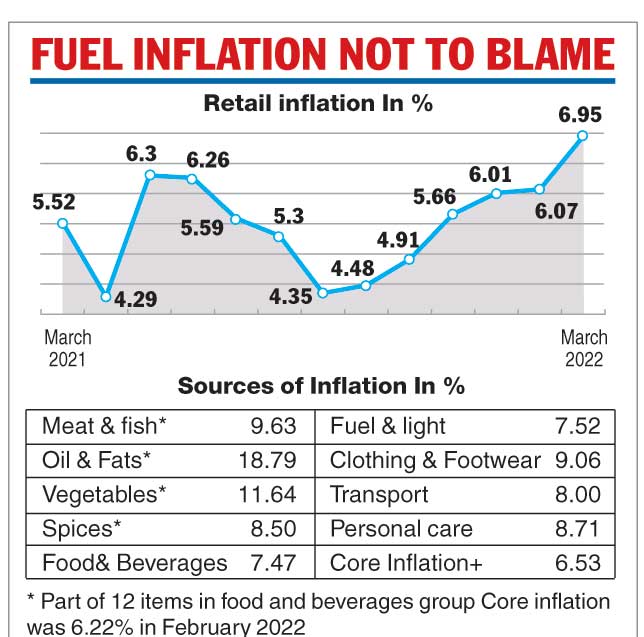

Retail inflation in March at 6.95 per cent is much above the RBI’s tolerance level of 6 per cent but fuel prices have played no part in this surge, busting the myth that this inflation is being stoked by spiralling crude prices following the Russian invasion of Ukraine.

Inflation in the “fuel and light” category at 7.52 per cent in March was not only lower than fuel inflation of 8.73 per cent in February but also the lowest in the segment since April 2021.

Analysts warned the impact of the crude price surge — Brent had touched $140 per barrel after the war broke out on February 24 — would only be visible in future data, meaning inflation would likely stay at the elevated level in the coming months.

Retail inflation spiked to a 17-month high in March above the upper limit of the RBI’s tolerance band for the third straight month.

Data released by the National Statistical Office showed the price surge was led by edible oils (up 18.79 per cent), vegetables (11.64 per cent), meat and fish (9.63 per cent) and footwear and clothing (9.4 per cent).

Food prices, which contribute to nearly half of the consumer price index, climbed 7.68 per cent year-on-year in March compared with 5.85 per cent a month before.

“With the increase in the cost of essential medicines from April, health inflation is likely to exert further pressure . The gradual fuel price increase had limited impact on March inflation,” Sunil Kumar Sinha, principal economist, India Ratings and Research, said.

Sinha said structural health inflation, higher commodity prices and weak currency would keep inflation rate elevated at least in the first quarter of FY23.

Icra chief economist Aditi Nayar said most price segments were in line with their forecasts, suggesting a gradual pass through of the commodity price pressures has commenced.

“With the MPC of the RBI having signalled an imminent stance change, the rate hike cycle may begin as early as June 2022, if the next CPI inflation print doesn’t significantly cool off from March,” she said.

"The pass-through of elevated global oil prices to the transport sector could indirectly affect the prices of other commodities,adding to the core pressures. If the pressure persists, it could hurt the nascent demand recovery as manufacturers will pass the rising input costs to the end consumers," CareEdge said in a research note.

US inflation at 40-year high

Inflation in the US soared over the past year at its fastest pace in more than 40 years, with costs for food, gasoline, housing and other necessities squeezing American consumers and wiping out the pay raises that many people have received.

The labour department said Tuesday that its consumer price index jumped 8.5 per cent in March from 12 months earlier — the biggest year-over-year increase since December 1981.

Prices have been driven up by bottlenecked supply chains, robust consumer demand and disruptions to global food and energy markets worsened by Russia’s war against Ukraine.

AP