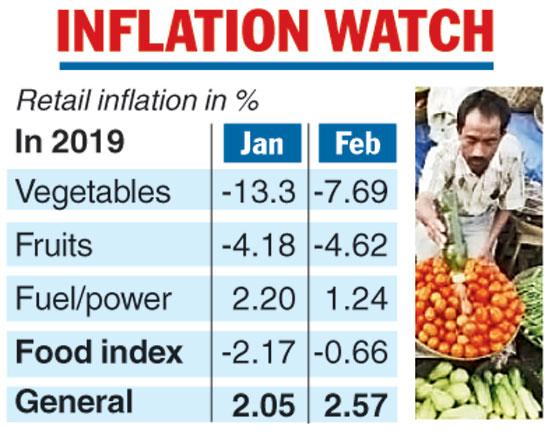

Retail inflation rose to a four-month high of 2.57 per cent in February, driven by higher food prices, but remained lower than the RBI’s expectations, giving hope the central bank could cut the key interest rate in its policy review next month.

Retail inflation based on Consumer Price Index (CPI) stood at 1.97 per cent in January and 4.44 per cent in February 2018. Food inflation based on CPI, however, was in negative at 0.66 per cent. The Reserve Bank factors in retail inflation while deciding on its monetary policy.

“With inflation remaining below the RBI target, inflationary expectations declining and growth profile weakening, the RBI may front load monetary easing in the beginning of 2019-20,” said Devendra Pant, chief economist of India Rating.

Economists said inflation remained subdued because of high unemployment and decline in rural incomes following a fall in food prices.

The unemployment rate rose to 7.2 per cent in February, the highest since September 2016, and up from 5.9 per cent in February 2018, according to data compiled by the Centre for Monitoring Indian Economy.

Data showed food inflation stood at -0.66 per cent in February compared with -2.17 per cent in January, fuel and light inflation stood at 1.24 per cent in February compared with 2.2 per cent in January.

Housing inflation stood at 5.10 per cent compared with 5.2 per cent in January. Clothing and footwear inflation was at 2.73 per cent against 2.95 per cent in January.

Inflation in the households goods and services segment was 6.29 per cent against 6.45 per cent in January. Inflation in the transport and communication segment came in at 3.08 per cent compared with 3.44 per cent in January.

Rating agency CARE said it expected CPI inflation “to move towards 3 per cent by March”.

The Telegraph