The Reserve Bank of India (RBI) will hold a special meeting of its monetary policy committee on November 3 where — for a change — its members will not be scratching their heads to decide whether or not to raise interest rates to slay the spectre of inflation.

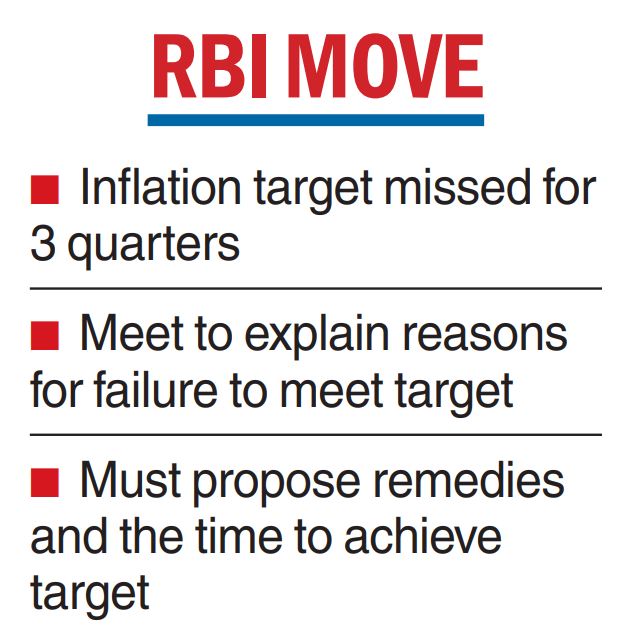

Instead, the panel will be meeting to compose a nuanced, and possibly elaborate, letter to explain why they slipped up on their mandate to hold inflation within the mandated range of 2 to 6 per cent for three consequent quarters.

This is for the first time since its constitution in 2016 that the six-member interest rate-setting body is meeting for such a purpose.

RBI governor Shaktikanta Das has said the central bank will not make the report public. Sources, however, said that the Centre is within its right to publicise the note.

The RBI’s announcement came on a day the US economy grew at an annual rate of 2.6 per cent in the July-September quarter.

This better-than-expected number, however, did not diminish expectations of a looming recession.

Market circles said they have discounted the impact of the special MPC meeting on stocks and the rupee and it will not have any material impact on trading on Friday.

However, the rupee may rally on hopes that the US Fed may go slow on its aggressive rate hikes.

In the trading on Thursday, the domestic currency ended at 82.50 a gain of 23 paise over its last close of 82.73 against the greenback on hopes that the Fed will reduce the interest rate hike to 50 basis points in December. The SGX Nifty was hinting at a positive opening on Friday.

“Under the provisions of Section 45ZN of the Reserve Bank of India (RBI) Act 1934... an additional meeting of the MPC is being scheduled on November 3, 2022,” the RBI said in a statement on Thursday.

This section deals with the failure to meet the inflation target — which is four per cent with a band of +/-2 per cent.

Retail inflation has consistently been above the upper bound of 6 per cent since January and the RBI has hiked the policy repo by 190 basis points this year to tackle elevated inflation.