The Reserve Bank has decided to review and strengthen the risk-based supervision (RBS) of the banking sector to enable financial sector players to address the emerging challenges.

The RBI uses the RBS model, including both qualitative and quantitative elements, to supervise banks, urban co-operatives banks, non-banking financial companies and other financial institutions.

“It is now intended to review the supervisory processes and mechanism in order to make the extant RBS model more robust and capable of addressing emerging challenges, while removing inconsistencies, if any,” the RBI said while inviting bids from technical experts/consultants to carry forward the process for banks.

“It is intended to review the existing supervisory rating models under the CAMELS approach for improved risk capture in a forward looking manner and for harmonising the supervisory approach across all SEs,” it said.

The annual financial inspection of UCBs and NBFCs is largely based on the CAMELS model (capital adequacy, asset quality, management, earnings, liquidity, and systems & control).

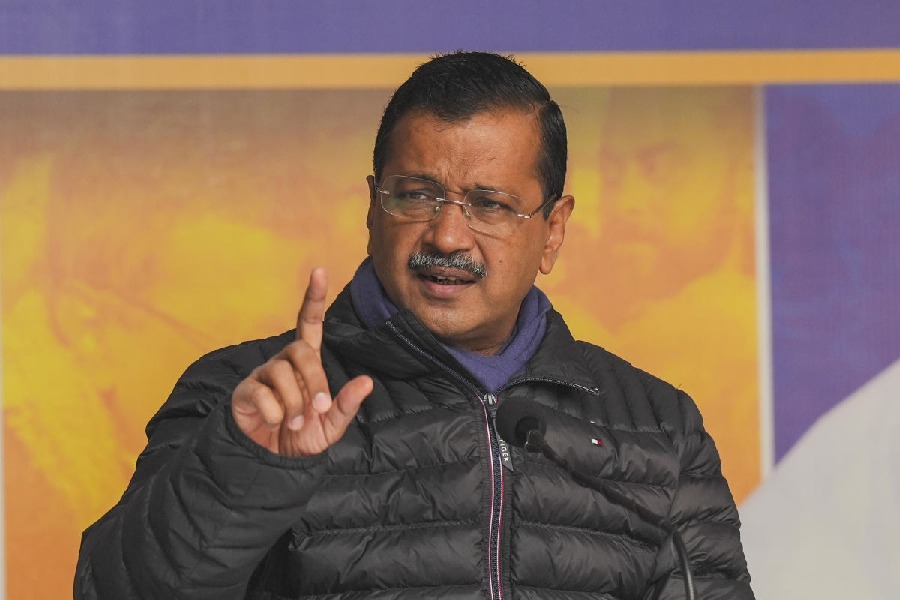

Deputy governor

The government has appointed RBI executive director T. Rabi Sankar as the fourth deputy governor of the central bank. Sankar fills the vacancy created by the retirement of B. P. Kanungo on April 2, after completing one-year extension.

In the case of UCBs and NBFCs, the expression of interest (EOI) for “consultant for review of supervisory models” said the supervisory functions pertaining to commercial banks, UCBs and NBFCs are now integrated, with the objective of harmonising the supervisory approach based on the activities/size of the supervised entities (SEs).