The Reserve Bank of India is likely to persuade banks to increase the lowball interest on savings bank accounts.

The regulator has not been terribly pleased about the manner in which several leading banks have held down the savings bank rate well below 4 per cent — at a time when interest rates have risen across the board after the policy-setting repo rate climbed by 250 basis points since April 2022.

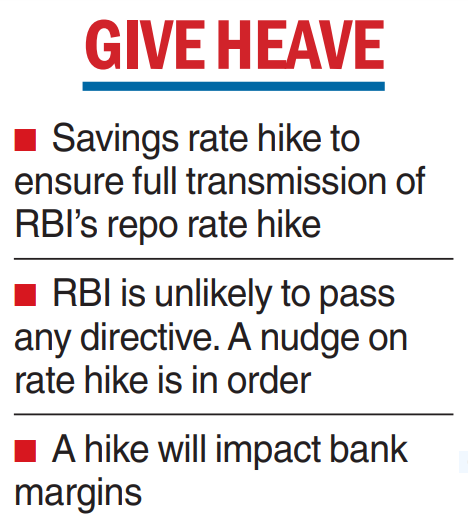

The RBI is not likely to direct banks to raise the savings bank rate; after all, it is beyond the remit of the monetary policy committee (MPC) which began its three day meeting on Wenesday. But there is growing speculation that it may opt for a little bit of suasion — a little nudge after sounding the alert in October over the tear-away growth in unsecured consumer loans.

Last month, the RBI increased the risk weightage on banks’ exposure to personal loans and credit cards.

“The RBI’s consistent discomfort, with runaway growth in unsecured loans, ultimately resulted in tighter regulatory norms. In the same vein, the RBI has voiced its dissent about lower (less than 4 per cent) and near-stagnant saving account (SA) deposit rates for many banks, including large banks versus a 250 basis points increase in repo rate,’’ a note from Emkay Research said.

The brokerage added that while the RBI will not intervene in banks’ commercial decisions, it may softly prod banks, instead of re-regulating the SA rate through any official directive.

"Higher SA rates could hurt growth/earnings of banks with higher SA deposit share unless mitigated by the increasing floating lending rates. Our BFSI team estimates that a 25 basis point increase in SA rate across banks could lead to an adverse impact of 5-9 basis points on net interest margins (NIM), 2-3 per cent on earnings per share (EPS), 3-4bps on RoA (return on assets) and 26-45 basis points on RoE (return on equity) for large private sector banks,’’ it noted.

Banking circles added that while the RBI has been asking them in various meetings

to look at raising savings bank rates, they have been reluctant to do so, given the impact that it will have on their margins.

A banker here added that the RBI is unlikely to come up with any specific measure that will regulate the SA rates.

The RBI began its tightening cycle in May last year which lasted till February 2023. During this period, the benchmark repo rate was raised by 250 basis points. Since February, the MPC has been on a pause mode. It is widely expected to continue this status-quo path this time as well. SA rates were deregulated by the RBI in December 2011.

In its October monetary policy report (MPR), the RBI noted that while the increase in term deposit rates in the tightening cycle has exceeded that of lending rates (both in terms of fresh and outstanding deposits/loans), the savings deposit rates of banks — which are a third of total deposits — have remained almost unchanged.

Among the PSU banks, SBI offers a savings interest rate of 2.70 per cent for balances of less than Rs 10 crore and 3 per cent for more than that amount.