The Reserve Bank of India (RBI) on Wednesday increased the repo rate by 35 basis points but adopted a hawkish stance on inflation. Analysts said this indicated that the tightening cycle would last longer than envisaged.

After a three-day meeting, the monetary policy committee (MPC) of the RBI raised the repo rate to 6.25 per cent. As a result both the standing deposit facility (SDF) and the marginal standing facility (MSF) rates were adjusted to 6 per cent and 6.50 per cent respectively.

The repo rate is the rate at which the RBI lends money to banks. MSF is a tool where banks in need of emergency cash can borrow from the RBI against government securities at higher than the repo rate, while SDF is a mechanism to absorb surplus liquidity from banks without any collateral.

India’s central bank has raised the repo rates four times since May 4 — three 50 basis points hikes in June, August and September following a 40bp increase in May. The RBI was now widely expected to moderate the hike to 35 basis points as inflation showed signs of easing amid concerns that growth may suffer on account of the aggressive monetary tightening.

However, to the disappointment of the bond markets, the central bank said that the battle against inflation was far from over though the worst was possibly behind the economy. Yields on the benchmark 10-year security ended higher at 7.27 per cent against the previous close of 7.25 per cent as the central bank flagged core inflation as an area of concern.

In a televised address, RBI governor Shaktikanta Das said that over the next 12 months, inflation is expected to remain higher than the 4 per cent target set by MPC. He cited core inflation — which excludes food and energy components — that has remained elevated at around 6 per cent. ``The main risk is that core inflation remains sticky and elevated,’’ he said.

“The worst with respect to inflation is over. But the battle against it continues. We are far from reaching a neutral rate. The first objective is to bring inflation within the tolerance band (2-6 per cent),” RBI deputy-governor Michael Patra said.

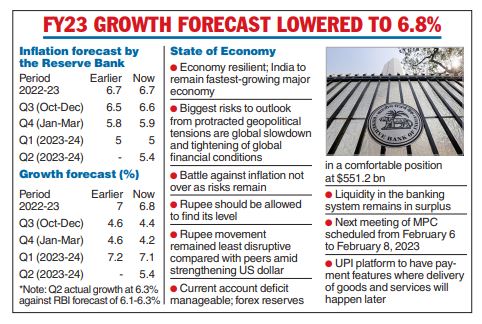

The RBI trimmed its GDP growth forecast for FY23 to 6.8 per cent from 7 per cent at the September meeting. Growth in Q3 was trimmed to 4.4 per cent from 4.6 per cent earlier, and Q4 sharply to 4.2 per cent from 4.6 per cent.

Inflation forecast has been retained at 6.7 per cent for the full year, which means it will stay above the mandate of 6 per cent on the upside.

“The policy tone was distinctly more hawkish than expected. When a central bank combines its sanguine view on growth with continued concerns on inflation – particularly the persistence in core inflation – it suggests that it is prepared to continue its fight against inflation and has the space and willingness to raise rates further,” Abheek Barua, Chief Economist, HDFC Bank said.

The BSE Sensex tumbled for the fourth session on the trot on Wednesday after the Reserve Bank raised the key interest rate and lowered the country’s GDP growth forecast to 6.8 per cent due to tightening of global financial conditions. Interest rate-sensitive realty, auto and bank stocks fell during the day.

“As the economy deals with the global headwinds, the RBI has become more realistic, lowering FY23 GDP growth forecast from 7 per cent to 6.8 per cent. The focus remains on fighting inflation which will lead to increase in interest rates in the future,” said Vinod Nair, head of research at Geojit Financial Services.

The rupee pared initial losses and settled marginally higher at 82.48 against the dollar on Wednesday.

With inputs from Delhi Bureau