In a surprise move, India’s central bank has hiked its key interest rate by a hefty 40 basis points as it steps up its fight against surging high inflation in the face of “tectonic shifts caused by the conflict in Europe.”

The Reserve Bank of India (RBI) raised its trendsetting repurchase rate, known familiarly as the repo, to 4.40 per cent from a historic low of 4.0 per cent where it’s been for the past two years as monetary policy authorities sought to shore up the pandemic-hit economy. Wednesday’s rate tightening was the first by the central bank since 2018.

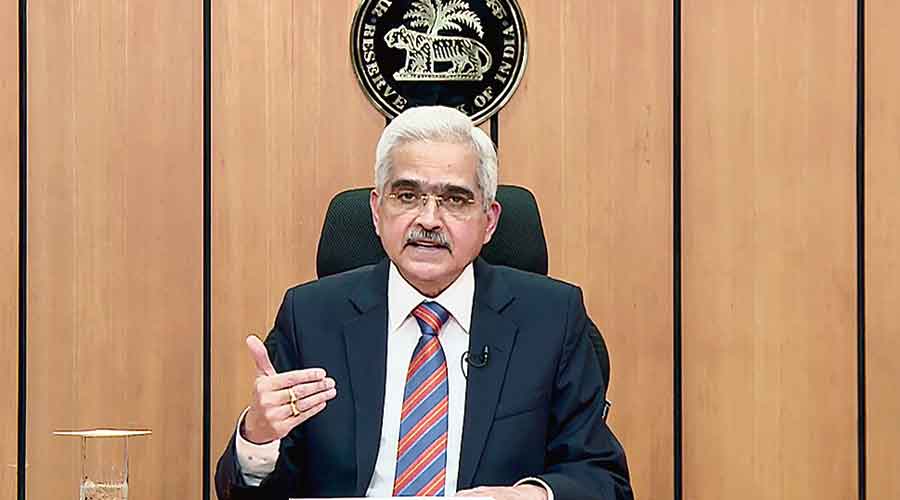

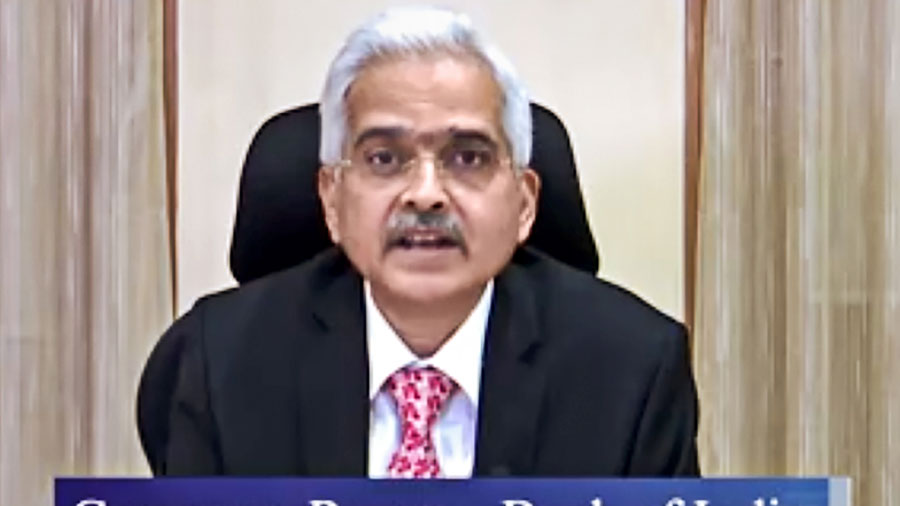

Reserve Bank Governor Shaktikanta Das said the rate hike was necessary as “globally inflation is rising alarmingly and spreading fast,” stoked by Russia’s war on Ukraine. He added that the economic challenges facing India and the rest of the world now are “humongous.”

The central bank has also increased the cash reserve ratio to 4.50 per cent from 4.00 per cent. It means commercial banks will have to park more money with the central bank, leaving the institutions with less to give as loans.

Markets taken aback

The central bank’s move to start unwinding the unprecedented stimulus it showered on the Indian economy during the pandemic took financial markets by surprise as monetary policymakers weren’t due to meet until next month. The central bank acted hours ahead of what was expected to be an aggressive 50-basis-point rate hike by the US Federal Reserve that would be the biggest since 2000.

"From being behind the curve for some time, the Reserve Bank of India has taken a big leap to try and bottle the inflation genie,” said Societe Generale economist Kunal Kundu.

The tightening announced after an emergency meeting of the monetary policy committee drove the 30-share benchmark Sensex down by nearly 2.30 per cent and sent prices of bonds tumbling. The rupee gained 0.1 per cent against the US dollar.

Policy 'accommodative'

For time being, Das said, that the bank’s policy remains “accommodative” but added that it would focus now on “careful and calibrated withdrawal of accommodation.” In other words, the days of ultra-low interest rates are coming to an end in India in line with similar monetary policy moves around the globe.

India “is not an island in this globally connected world,” Das said. The country is confronting the “synchronised shocks of (soaring) commodity prices, supply disruptions and higher inflation unleashed by the war,” he said.

“Inflation must be tamed in order to keep the Indian economy resolute on its course to sustained and inclusive growth,” Das said, warning that inflation pressures were becoming “more potent” than before.

6.95% in March

In India in March, headline inflation hit 6.95 per cent, nearly a percentage point above the central bank’s tolerance level, and April inflation figures due to be released soon are also expected to be “strong,” Das said.

"There is a collateral risk that inflation remains elevated at this level for too long and can de-anchor expectations" of inflation being controlled at lower levels, Das said. The aim of the rate hike is to “preserve macro-financial stability amidst increasing volatility in financial markets,” he said, pronouncing himself an “eternal optimist” that the actions taken by the bank would lead to a “better tomorrow.”

Das explained the bank’s move by saying that “geopolitical tensions are ratcheting up inflation to their highest levels in the last three to four decades in major economies while moderating external demand. Global crude oil prices are ruling above $ 100 per barrel and remain volatile.”

Global food prices

He added that global food prices touched a new record in March and have firmed up even further since then. Inflation sensitive items relevant to India such as edible oils are facing shortages due to the conflict in Europe and export bans by key producers. The jump in fertiliser prices and other input costs has a direct impact on food prices in India.

Furthermore, Das said that major economies are expected to tighten monetary policy significantly: “These developments would have ominous implications for emerging economies, including India,” Das said.

Meanwhile, “COVID-19 infections and lockdowns in major global production hubs will accentuate global supply chain bottlenecks while depressing growth,” he added.

Growth 7.2%

The bank left its GDP growth projection for the fiscal year 2022-23 at 7.2 per cent.

By advancing its expected rate hike by a month, the Indian central bank “has displayed its nimble-footedness and clearly completed the pivot back to inflation management,” Societe Generale economist Kundu said. Kundu forecast a “cumulative 100-125 basis points of repo rate hikes in fiscal year 2023."

The 30-share BSE Sensex slid 2.29 per cent or 1,307 points to close the day at 55,669. The broader NSE Nifty also shed 2.29 per cent or 392 points to finish at 16,678.

Around the world, central banks have been raising rates. Also on Wednesday, Iceland delivered its biggest rate hike since the 2008 financial crisis in a bid to curb inflation. It raised its leading seven-day term-deposit rate by 100 basis points to 3.75 per cent. On Thursday, the Bank of England is expected to hike its main bank rate for a fourth time, raising the rate by a quarter point to 1 per cent rate to rein in inflation riding at a 30-year high of 7 per cent. In the US, monetary authorities have been raising rates in a struggle to ease price pressures in the economy that are at their highest in four decades.