The Reserve Bank of India (RBI) intervened in the foreign exchange market on Thursday to prevent the rupee’s slide on account of a stronger greenback in the overseas market.

India's central bank has been engaged in some intricate manoeuvres to smother any volatility in the value of the rupee in the last seven months.

The Reserve Bank of India (RBI) intervened in the foreign exchange market on Thursday to prevent the rupee’s slide on account of a stronger greenback in the overseas market.

India's central bank has been engaged in some intricate manoeuvres to smother any volatility in the value of the rupee in the last seven months.

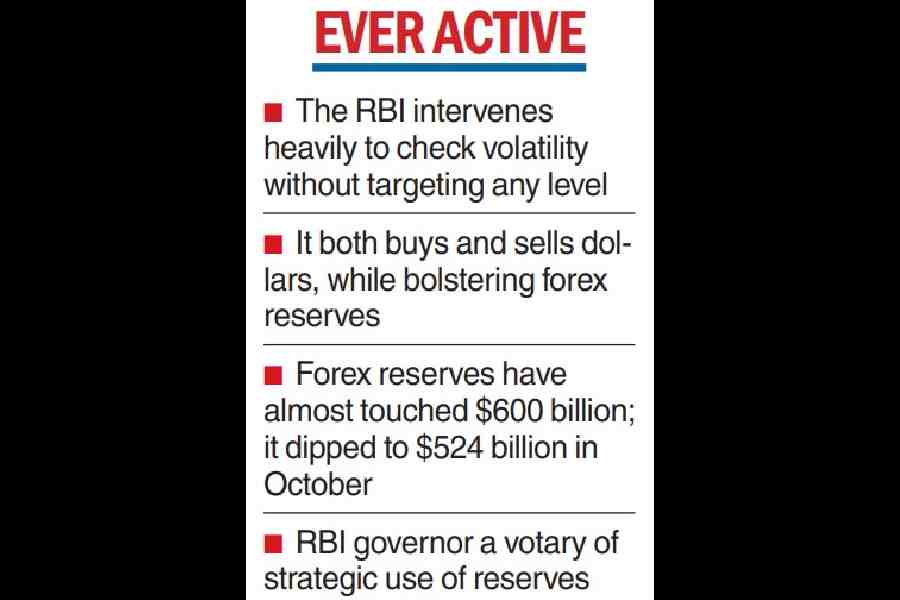

Intervening heavily, the RBI hasbeen both buying and selling dollars in the spot markets, while beefing up reserves at every available opportunity.

The central bank is understood to have sold dollars after the rupee fell to a low of 82.65 on Thursday as the US Dollar Index (DXY) rose more than 0.50 per cent to 103.40.

The DXY which gauges the greenback's strength against a basket of six currencies strengthened on expectations of a resolution on the US debt ceiling.

At the inter-bank forex market, the rupee opened at 82.36 but hit a two-month low of 82.66.

It is believed that at this stage the RBI sold dollars through PSU banks, resulting in the domestic unit closing at 82.60, a 22 paise fall over the last close of 82.38 against the dollar.

Though the rupee closed lower against the greenback, the importance of the RBI in the forex markets was unmistakable.

``The RBI has become a major player in the forex market. If we consider its gross intervention figures, which are published with a two-month lag, we would realise that they intervene regularly in the market, on both sides," Anindya Banerjee, VP — of currency derivatives and interest rate derivatives, at Kotak Securities, told The Telegraph.

"Between January and February of this year, their gross intervention in the spot was around $34.7 billion. If we add gross forward intervention and intervention in NDF (non-deliverable forward or currency derivative trading) and NSE futures, we would get an average daily intervention of over a billion dollars. They intervene regularly to contain volatility, without targeting any exchange level’’ Banerjee said.

RBI data showed India’s forex reserves increasing to an 11-month high of $598.95 billion in the week ended May 5, up from $588.8 billion in the preceding week.

While the rise can be attributed to inflows from foreign portfolio investors, analysts said the RBI had been beefing up the reserves, particularly since October 2022 when it fell to $524.5 billion.

India’s forex reserves had touched a high of $645 billion in October 2021.

The steep decline over the next year came as the RBI dipped into this purse to prevent a steep fall in the rupee which was adversely hit by a hawkish Fed.