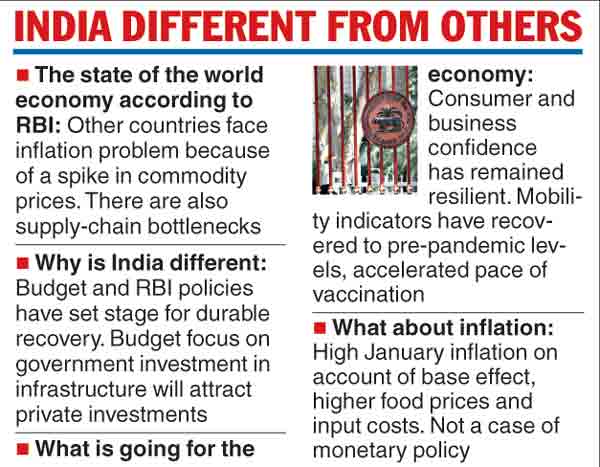

The Reserve Bank of India on Wednesday said the recovery path of the economy in the country is different from the rest of the world, which has been marked by rising inflation and supply bottlenecks.

In its monthly bulletin on the state of the economy, the RBI said the budget’s emphasis on government investments will help the economy recover quickly.

According to the central bank, the global economy is at an inflection point — with inflation getting entrenched across countries because of a spike in commodity prices and the persistence of supply chain bottlenecks.

While the global macro-economic situation remains in the grip of a heightened state of uncertainty, with risks tilted to the downside, the economic situation in India continues to improve.

“The Union Budget 2022-23 and the monetary policy announcement of February 10, have set the tone for a durable and broad-based revival. The renewed emphasis on public investment through infrastructure development is expected to crowd-in private investment and strengthen job creation and demand in 2022-23,’’ an article written by deputy governor Michael Debabrata Patra and others on the state of the economy in the bulletin said

Economic activity in India is recouping from a brief spell of moderation last month, in view of the less virulent effects of the Omicron virus.

Better planning and strategy, management of supply chain logistics and accelerated digitalisation have helped firms to mitigate the pandemic risks.

“As businesses return to new normal, hiring activities have gained traction — several Indian firms, global giants and start-ups have announced massive hiring plans for India. Buoyant revenue collections under the goods and services tax (GST), robust toll collections and e-way bill generations are all reflective of the ongoing revival,’’ the RBI said.

Despite the third wave, e-way bills generation was above pre-pandemic levels, though there was a sequential dip in January because of the restrictions.

The high retail inflation in January at 6.1 per cent — it was above the RBI's tolerance limit of 6 per cent — was attributed to an unfavourable base effect.

Food inflation was the main driver rising 5.6 per cent from 4.5 per cent in December, the RBI said. Both the manufacturing and services sector saw higher input costs, though it was more pronounced in the latter.

However, selling price increases, were muted across both these segments.

Zombie firms

The bulletin said zombie firms — perpetually loss-making companies — have absorbed almost 10 per cent of bank credit. It said the effectiveness of an accommodative monetary policy gets dampened by these companies since they used resources more for survival over investment as they use the loans to service their debt.

Weak banks often lend to such companies at higher interest rates, enabling their survival. The accommodative monetary policy and low interest rates have also helped these firms to remain in business.

The article on zombie firms in the bulletin said around 10 per cent of non-financial firms in India could be viewed as zombies.

Despite their greater leverage, the share of zombie firms in total sales of the non-financial corporate sector has also declined in recent times, which indicates that they have mis-allocated resources and hampered creative destruction in the economy.

Claims of high growth

The finance ministry on Wednesday said the Indian economy was poised to grow at the fastest pace among the larger economies in the world on the back of various initiatives taken by the government in the budget.

“Once the uncertainty and anxiety caused by the Covid-19 virus recedes from people’s minds, consumption will pick up and the demand revival will then facilitate the private sector stepping in with investments to augment production to meet rising demand,” the finance ministry’s monthly economic review said.

“Barring external shocks – geo-political and economic – this scenario should play out for the Indian economy in 2022-23,” the ministry said.

“The budget commitments towards asset creation (public infrastructure development) will invigorate the virtuous cycle of investment and crowd in private investment with large multiplier effects.”