The Reserve Bank of India (RBI) on Wednesday raised its benchmark repo rate by 25 basis points to stamp out sticky core inflation and signalled a hawkish note on remaining in a liquidity tightening mode.

This is the sixth repo rate hike this fiscal since the sudden off-cycle hike in early May. With the increase, the repo has gone up 250 basis points.

The latest hike means that home loan rates will go up once again, raising the burden on borrowers all over again.

The six-member monetary policy committee (MPC) was split 4:2 when it hiked the policy repo rate as two members — Ashima Goyal and Jayanth R. Varma — voted against the increase.

Though the hike was in line with market expectations, the RBI belied hopes of being more bold by keeping rates unchanged or offering a more positive guidance.

The MPC also remained focused on withdrawal of its accommodation policy “to ensure that inflation remains within the target going forward, while supporting growth”. Both Goyal and Varma also voted against the withdrawal of accommodation.

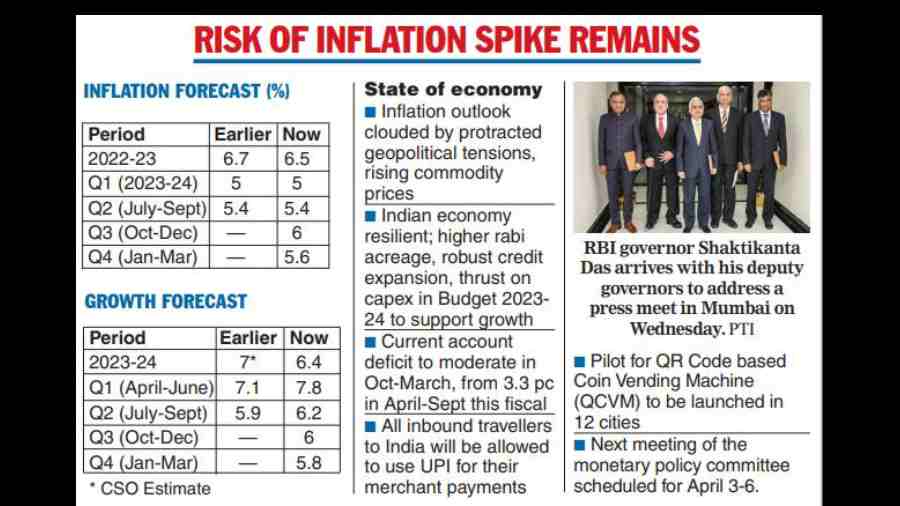

The RBI lowered the inflation projection for the current fiscal year to 6.5 per cent from 6.7 per cent given in the previous meeting, even as it remained worried over core inflation.

Inflation has fallen for two consecutive months in November and December by a combined 105 basis points from 6.8 per cent in October — a key reason behind lowering the projections.

However, considerable uncertainties remain on the likely trajectory of global commodity prices, including the price of crude oil. Besides, commodity prices may remain firm with the easing of Covid19 related restrictions in some parts of the world.

The forecast for growth has been lowered to 6.4 per cent for the next fiscal from 6.8 per cent projected in December and 7 per cent by the Central Statistics Office (CSO).

RBI governor Shaktikanta Das said the economy remains resilient as it has withstood global shocks over the last three years whereas major economies in the world are still reeling from the pandemic and the Ukraine war.

Protracted geo-political tensions, tightening global financial conditions and slowing external demand may pose downside risks to domestic output, the RBI said.

In a televised address, Das said while headline inflation has moderated with negative momentum in November and December, core inflation — inflation stripped of food and fuel components — has remained sticky.

“We need to see a decisive moderation in inflation. We have to remain unwavering in our commitment to bring down inflation. Thus, monetary policy has to be tailored to ensuring a durable disinflation process.’’

He said a gradual reduction in the repo hike to 25 basis points from 35 basis points in December offers an opportunity to evaluate the effects of the actions taken so far on inflation and the economy.

With the latest hike, the real policy rate — repo rate adjusted for inflation projection four quarters ahead — has moved into positive territory at 90 basis points.

RBI deputy-governor Michael D Patra said the level of real policy rate in the current tightening cycle will depend on evolving macro-economic conditions. The RBI will not necessarily be guided by what was prevailing prior to the pandemic when it stood at over 200 basis points.

Suman Choudhury, chief analytical officer, Acuite Ratings and Research, said the RBI has maintained a hawkish tone in its statement.

“There is no indication of any pause in the rate hike and the likelihood of further moderate hikes in the repo rate remains, depending on the upcoming data prints”.

Abheek Barua, chief economist at HDFC Bank, also felt the central bank was hawkish as the MPC recognised they are still away from achieving the objective of durable disinflation.

``In terms of the inflation risks, the RBI highlighted the elevated nature of core inflation and continuing global risks that could push up domestic inflation The central bank is likely to become more data dependent, and this does not rule out another rate hike in the upcoming policy,’’ he said.