Mittal, who grew up in Calcutta, is counted among the richest Indians because of his stake in ArcelorMittal.

Despite having operations in several countries, Mittal is yet to set up a stronghold in India. The Rs 42,000-crore offer made by ArcelorMittal — which has the backing of the committee of creditors — has provided only a pittance to operational creditors like RIL.

Legal observers say cases filed by operational creditors could prove to be a major stumbling block that ArcelorMittal will need to negotiate before it wins approval from the NCLT.

The plan, which promises to pay off dues of most of the secured financial creditors, was cleared by the CoC where the SBI had a majority vote.

The Ruias, who had made a late offer that was eventually rejected by the NCLT last Tuesday, had proposed to pay off all operational creditors in full and in three instalments.

Meanwhile, a section of the operational creditors had approached the National Company Law Appellate Tribunal on Wednesday in an effort to stymie the NCLT hearing on the ArcelorMittal petition tomorrow. But the tribunal refused to hear the matter.

The Telegraph

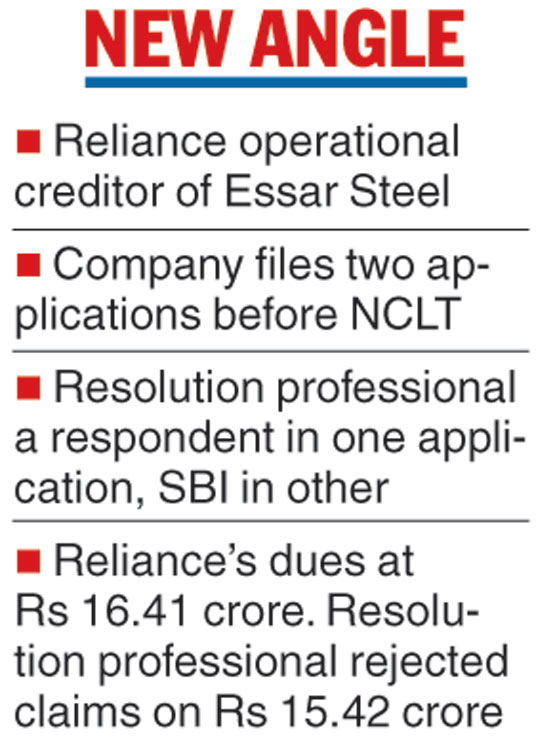

Reliance Industries, India’s biggest company by market capitalisation, has waded into the Essar Steel bankruptcy case, the fiercest legal battle raging in India’s insolvency landscape.

The company, majority owned by Asia’s richest man billionaire Mukesh Ambani, has filed two applications before the National Company Law Tribunal (NCLT), Ahmedabad.

The applications will come up for hearing on Thursday and the bench, comprising Harihar Prakash Chaturvedi and Manorama Kumari, is likely to take up the applications for hearing before admitting them. There are 44 other applications listed for hearing.

In one of the applications, Satish Kumar Gupta, the resolution professional (RP) in Essar Steel India Ltd, has been made the respondent.

In the other case, the State Bank of India, which has the biggest say in the committee of creditors because it has the highest exposure valued at Rs 15,431 crore, has been made the main respondent.

RIL is listed as one of the operational creditors to Essar Steel with a total claim valued at Rs 16.41 crore. However, the RP rejected as much as Rs 15.42 crore of RIL’s claim against Essar and admitted a little over Rs 99 lakh.

The Reliance move comes at a crucial stage in the 18-month battle for control of Essar Steel between the Ruias and Lakshmi Niwas Mittal-owned ArcelorMittal.

ArcelorMittal, the world’s largest steelmaker, is on the verge of gaining control of Essar Steel after the NCLT ruled on Tuesday that the Ruias-led consortium’s offer of Rs 54,389 crore was not maintainable under the rules governing the bankruptcy resolution process.

The 8-million-tonne prized asset located on the west coast in Gujarat, where RIL’s jumbo refinery and petrochemical complex is also based, will provide a much needed toehold to Mittal in his home soil India, which has emerged as one of the brightest investment spots in global steel landscape.