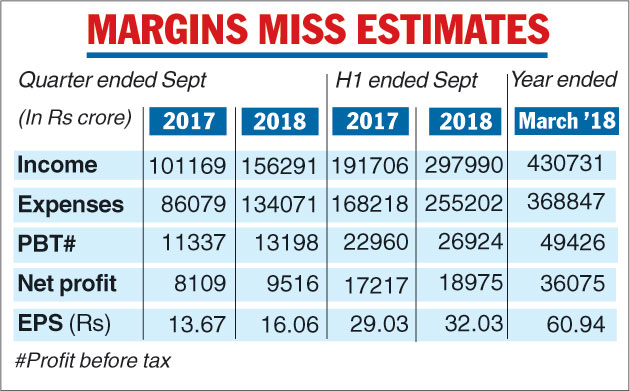

Reliance Industries (RIL) on Wednesday reported numbers that were largely in line with estimates with petrochemicals and the consumer-facing business leading the show. Consolidated net profits for the second quarter ended September 30 registered a 17.4 per cent growth at Rs 9,516 crore compared with Rs 8,109 crore in the same period last year.

Analysts had expected the oil-to-retail giant to post profits in the region of Rs 9,500-9,700 crore.

The performance came with positive contributions from the petrochemicals, organised retail and telecom business. RIL’s revenues from the petrochemicals segment showed an increase of 56 per cent to Rs 43,745 crore because of an increase in volume and price realisations.

However, on the refining and marketing front, revenues during the period showed a rise of 42 per cent to Rs 98,760 crore but earnings before interest and taxes fell 20 per cent to Rs 5,322 crore.

A key highlight of the division’s performance was its gross refining margins (GRMs), which came below analysts’ estimates.

GRMs during the period stood at $9.5 per barrel which was lower than the $10 per barrel as was expected by analysts. This was on account of a shutdown of its fluid catalytic cracking unit (FCC) during the period.

However, in the organised retail business, revenues showed a growth of 122 per cent to Rs 32,436 crore. RIL said accelerated store expansion, strong value proposition and focus on customer experience across all consumption baskets resulted in this robust growth. Further, the segment EBIT rose by a strong 273 per cent to Rs 1,244 crore.

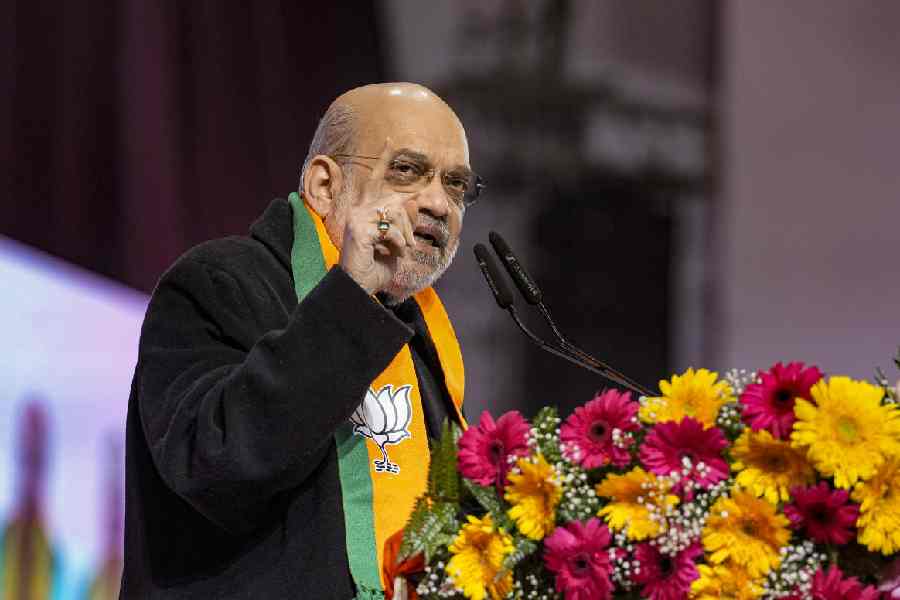

“Our company delivered robust operating and financial results for the quarter despite macro headwinds, with strong growth in earnings on a year- on-year basis. Our integrated refining and petrochemicals business generated strong cash flows in a period of heightened volatility in commodity and currency markets,” Mukesh Ambani, chairman and managing director of RIL, said

“Our commitment to create consumer value is gathering momentum, with the robust scale-up of India centric consumer facing businesses. The financial performance of both Retail and Jio reflect the benefits of scale, technology and operational efficiencies.”

For the quarter, RIL reported revenues of Rs 156,291 crore, an increase of 54.5 per cent compared with Rs 101,169 crore in the corresponding period of the previous year.

Jio show

It was a mixed bag for RIL in the digital services business as its arm Reliance Jio reported profits for the September quarter but saw lower average revenue per user (ARPU).

Net profits at Jio came in at Rs 681 crore compared with Rs 612 crore in the preceding quarter. Revenues from operations showed a growth of almost 14 per cent on a sequential basis when they stood at Rs 9240 crore.

However, the ARPU declined to Rs 131.7 per subscriber per month from Rs 134.5 in the preceding quarter.

Jio added that during the period, it accelerated the pace of subscriber additions further with net addition of 37 million (against 28.7 million in the previous quarter), highest in any quarter since the launch of commercialservices.

Further, customer engagement continued to grow with average data consumption per user per month of 11 GB and average voice consumption of 761 minutes per user per month.

Investments

Reliance took yet another step to improve its last-mile connectivity to homes when it announced acquisition of stakes in Den Networks and Hathway Cable and Datacom at an investment of over Rs 5,000 crore.

RIL said there will be a primary investment of Rs 2,045 crore through a preferential issue in Den Networks and a purchase of Rs 245 crore from the existing promoters for a 66 per cent stake.

Further, there will be a primary investment of Rs 2,940 crore through a preferential issue for a 51.3 per cent stake in Hathway Cable and Datacom Ltd.

RIL feels that the transactions will create a win-win outcome for the local cable operators, consumers and content providers.

It pointed out that through these investments, Reliance and Jio will be strengthening the 27,000 local cable operators that are aligned with DEN and Hathway to enable them to participate in the digital transformation of the country through access to superior back-end infrastructure, tie-ups with content producers, access to latest business platforms to improve business efficiencies and deliver customer experience.