Reliance Industries Ltd on Friday topped analyst estimates by a mile when it posted a 41.58 per cent rise in net profit for the quarter ended December 31, 2021 following a strong performance across the key business lines of oil to chemicals (O2C), retail and telecom.

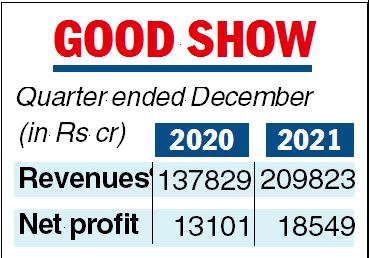

Consolidated net profit of the conglomerate came in at Rs 18,549 crore compared with Rs 13,101 crore in the corresponding period of the previous year. Brokerages such as Emkay had expected a net profit of around Rs 16,138 crore.

Net profit post exceptional items stood at Rs 20,539 crore against Rs 14,894 crore in the year-ago period. RIL’s consolidated gross revenues shot up 52.2 per cent to Rs 2,09,823 crore during October-December up from Rs 1,37,829 crore in the year-ago quarter.

The better than expected performance was largely led by its O2C and retail business, though telecom did not disappoint. Jio Platforms Ltd (JPL) which represents the entire digital services business reported net profit of Rs 3,795 crore against Rs 3,486 crore a year ago — a rise of almost 9 per cent.

Its earnings before interest, taxes, depreciation and amortisation (EBITDA) crossed the Rs 10,000-crore mark at Rs 10,008 crore against Rs 8,483 crore a year ago. Gross revenues rose to Rs 24,176 crore from Rs 22,858 crore, a growth of around 14 per cent. RIL said the average revenue per user (ARPU) stood at Rs 151.6 per subscriber, an increase of 8.4 per cent growth.

Within JPL, Reliance Jio Infocomm (RJIL) posted a better than expected net profit of Rs 3,615 crore against Rs 3,291 crore a year ago. Its revenue from operations rose to Rs 19,347 crore from Rs 18,492 crore.

However, the O2C business stole the show with a 57 per cent growth in revenues at Rs 1,31,427 crore from Rs 83,838 crore in the third quarter of 2020-21. The segment earnings before interest, taxes, depreciation & amortization (EBITDA) gained almost 39 per cent to Rs 13,530 crore (Rs 9,756 crore).

RIL said the bump-up in revenues came on account of increase in crude oil prices and higher volumes. Though the domestic polymer demand was subdued, intermediates such as paraxylene showed a good growth.

The organized retail business also benefited from the festival season and operating environment returning to normality. RIL said Reliance Retail posted an all-time high revenue of Rs 57,714 crore against Rs 37,845 crore — a rise of 53 per cent.

However, at the end of the quarter, outstanding debt was higher than the cash & cash equivalents. It stood at Rs 2,44,708 crore while cash & cash equivalents were at Rs 2,41,846 crore.

``Reliance has posted best-ever quarterly performance in the third quarter of 2021-22 with strong contribution from all our businesses. Both our consumer businesses, retail and digital services have recorded highest ever revenues and EBITDA. During this quarter, we continued to focus on strategic investments and partnerships across our businesses to drive future growth’’, Mukesh D Ambani, chairman & managing director, RIL said while commenting on the results.