A few months down the line if you walk into your neighbourhood retail store don’t be surprised if you find a Jio-badged QR code — or, if you step into a Reliance Digital outlet, you may find a Jio executive hawking a consumer durable loan.

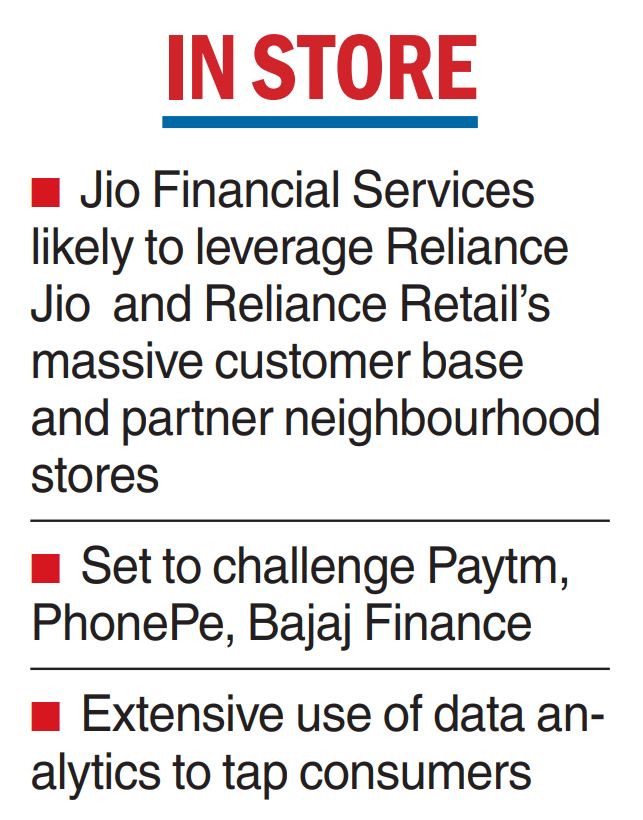

These are the shape of things to come after last week’s announcement by Reliance Industries Ltd (RIL) that it would demerge its financial services business. However, a key implication of this development is that Reliance will be stepping into the turf of Paytm, PhonePe, and even Bajaj Finance.

It is early days yet since its plans will only be known after the company gets all the approvals from its shareholders, creditors and NCLT for the proposed demerger.

Observers said that the captive base of over 16,600 outlets, its partner kirana stores, and a registered customer base of over 22 crores apart from its deep pockets could make Reliance a force to reckon with in the coming years. The possibility of RIL acquiring fintech firms and even small to medium NBFCs to ramp up the businesses are not being ruled out.

Announcing the demerger last week, Reliance said that the financial services arm will also incubate other verticals such as insurance, payments, digital broking and asset management. The plan is to hive off its financial services undertaking into Reliance Strategic Investments Ltd (RSIL), which will be renamed as Jio Financial Services Ltd (JFSL).

“It remains to be seen whether Reliance targets small-ticket loans or higher-ticket loans, the strategy at the merchant level. In any case, it could compete against the likes of Paytm and Bajaj Finance,’’ an analyst said.

The entry of Reliance comes at a time Paytm has been scaling up its loan distribution business.

Analysts at BofA Securities said in a report that the key business model of JFS revolves around consumer and merchant lending based on proprietary data analytics on RIL’s retail & Jio platforms. JFS would likely have cheaper access to capital given parent company RIL’s 50 per cent plus ownership — even post-listing — strong credit rating.

“By separating financial services from the core business, RIL appears to be keeping arm’s length transaction from its other entities and in theory helping it better to attract strategic or JV partners,’’ they said.