Reliance Industries (RIL) is planning to raise funds through the issue of non-convertible debentures (NCDs) even as questions are being raised about its target of becoming a zero net debt company by March 2021.

The oil-to-telecom giant said in a regulatory filing on Monday that its board will meet on April 2 to consider “raising of funds by way of issuance of listed, secured/unsecured, redeemable non-convertible debentures on private placement basis, in one or more tranches/series’’.

The company did not disclose the reasons behind the latest fund raising or its size, which could be known after the board meeting.

Reliance’s plan to mop up NCDs may just be an exercise to replace high-cost debt with low-cost ones. But it does come a time its zero net debt goal is threatened by fears of a global recession on account of the Covid-19 pandemic and the fall in global crude price. RIL has a debt of Rs 1.53 lakh crore.

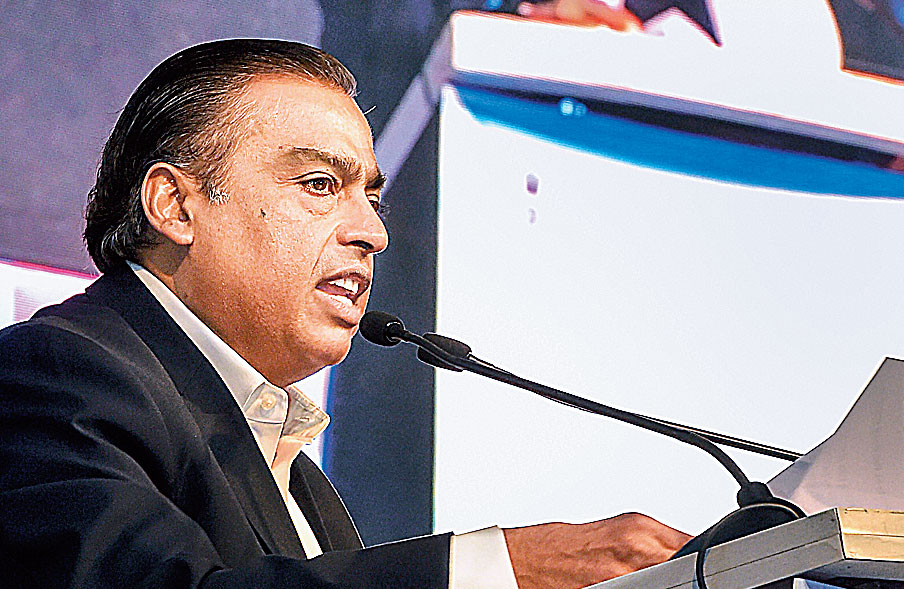

At its annual general meeting in August last year, chairman Mukesh Ambani had laid out plans to be a zero net debt company by March 2021.

A critical part of the plan was the proposed sale of 20 per cent in its oil-to-chemical (O2C) business to Saudi Aramco for around $15 billion.

Apprehensions have grown over the deal with crude prices dropping to their lowest in 18 years and concerns being raised about the margins of Reliance’s petchem businesses.

Reliance may also reduce debut by its previously announced plans to bring in strategic investors to its fibre InvIT business or digital services platforms. However, it remains to be seen if RIL is successful on these fronts in the current environment.

Share prices of RIL on Tuesday, however, rallied on the fund raising plan. On the BSE, the scrip surged close to 8 per cent, or Rs 80.10, to end at Rs 1,112.45. At the current prices, the RIL share is 30 per cent down from its 52-week-high of Rs 1,617.80.

“RIL has fallen over 30 per cent from recent peaks as Covid-19 hammered global markets. RIL’s refining, petchem and retail businesses stand affected by travel restrictions that hit global oil demand, reduction in trade activities and consumption, and lockdowns,” brokerage Emkay Research has said.

Meanwhile, Reliance Jio has offered its users 100 minutes of free talktime and 100 free text messages till April 17, which is 10 times more than its rivals have offered during the lockdown.