Reliance Industries on Thursday became the first Indian company to hit the Rs 10 lakh crore market valuation mark following a spike in its share price.

At market close, the oil-to-telecom conglomerate's market capitalisation (m-cap) zoomed to Rs 10,01,555.42 crore on BSE.

The stock rose 0.65 per cent to close at Rs 1,579.95 on BSE. During the day, it jumped 0.90 per cent to an all-time high of Rs 1,584.

At the NSE, it gained 0.77 per cent to close at Rs 1,582.

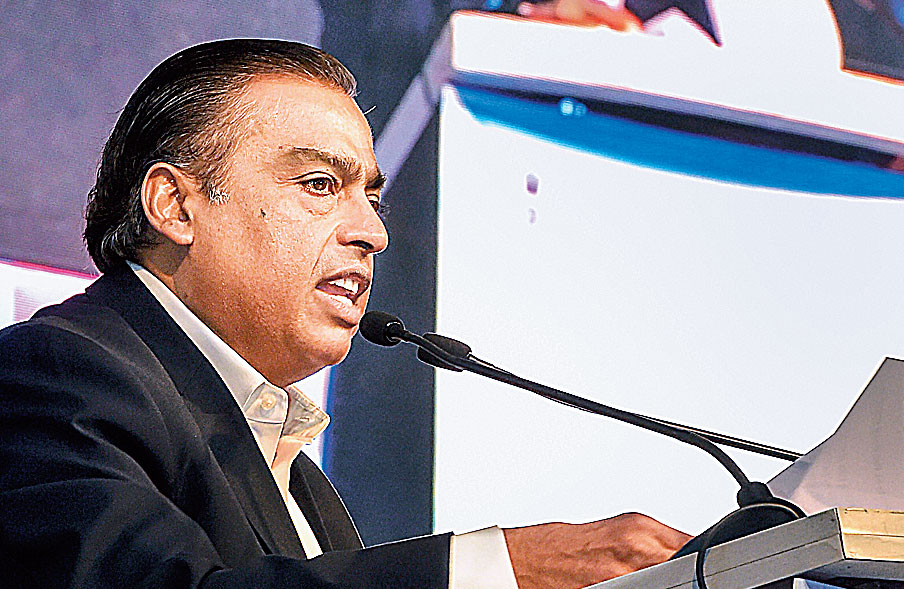

'It was only a matter of time for business tycoon Mukesh Ambani's company to test this milestone, considering the past investments made in consumer-facing sectors like telecom and retail. These investments have yielded fruitful results for the company and has been consistently increasing their share in the overall profits,' according to Ajit Mishra, VP Research, Religare Broking.

Since the past few sessions, the company's market valuation has been hovering near the Rs 10 lakh crore-mark.

On the volume front, 2.73 lakh shares of the company were traded on the BSE and over 62 lakh shares on the NSE during the day.

The company is still ahead of British energy major BP Plc in terms of market valuation. BP Plc's m-cap was at USD 127.86 billion at close of trade on NYSE.

'RIL today became the first Indian company to hit the Rs 10 lakh crore milestone in market capitalisation, after its shares rose to a record high. We will put two important factors that should be seen as a catalyst for this share. Firstly, the Reliance Jio disruption. Second is the stake sale to Aramco has further made its valuation going forward attractive since their aim to achieve the debt-free balance sheet is likely to be seen in FY20-21,' said Mustafa Nadeem, CEO, Epic Research.

In October this year, Reliance Industries (RIL) hit the Rs 9 lakh crore m-cap level.

In August 2018, it became the first Indian company to have crossed the Rs 8 lakh crore m-cap mark.

So far this year, the company's scrip has zoomed nearly 41 per cent, much higher than the 14 per cent rise in Sensex so far in 2019.

TCS is the country's second most valued firm with a market valuation of Rs 7,79,501.64 crore, followed by HDFC Bank with a market cap of Rs 6,92,853.48 crore, Hindustan Unilever (Rs 4,51,482.38 crore) and HDFC (Rs 3,98,994.81 crore).

The m-cap figures of companies change daily with stock price movement.