Kishore Biyani’s Future Group is reportedly in talks with Mukesh Ambani’s Reliance to sell its retail and supply chain businesses.

Biyani, who ushered in the organised retail revolution in the country, is said to be looking at an enterprise valuation of Rs 10,000 crore for a very large swathe of his empire that will now be carved out and sold.

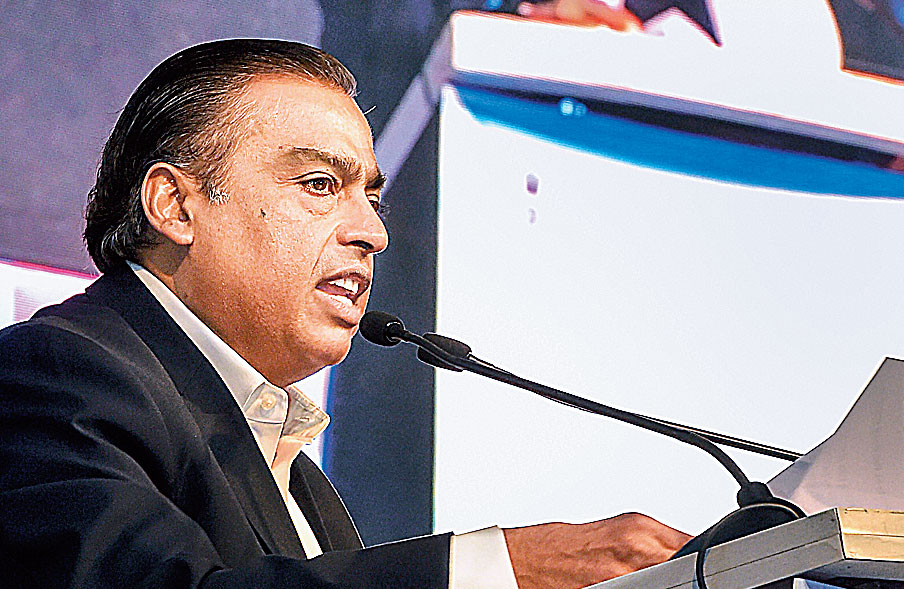

If a deal is struck — and this will hinge on several factors with valuation being the pre-eminent one — it will consolidate Mukesh Ambani’s position in India’s retail sector.

Kishore Biyani did not comment on the development despite calls and text messages sent to his mobile over the past 12 days.

A Reliance spokesperson said: “As a policy, we do not comment on media speculation and rumours. Our company evaluates various opportunities on an ongoing basis.

“We have made and will continue to make necessary disclosures in compliance with our obligations under the Securities Exchange Board of India (Listing Obligation and Disclosure Requirements) Regulations 2015 and our agreements with the stock exchanges.”

Future Retail reported annual revenues of Rs 20,165 crore in the year ended March 2019 and a net profit of Rs 733 crore.

In the third quarter of 2019-20, it had reported revenues of Rs 5,129 crore and a net profit of Rs 170 crore.

According to a note prepared by Edelweiss Research, Future Retail has 1,388 stores across various formats, including Big Bazaar, Fashion at Big Bazaar (FBB), ezone, and Foodhall.

In comparison, Reliance Retail, which is part of Reliance Industries, has 11,784 stores spread across a sprawl of retailing verticals from apparel to consumer electronics, and from fashion to jewellery.

The organised retailing arm of Reliance reported revenues of Rs 162,936 crore and EBITDA of Rs 9,654 crore in the year ended March 31.

The Future Retail stock, which has toppled from a 52-week high of Rs 489.25 in June last year, closed at Rs 104.5 on the Bombay Stock Exchange on Wednesday.

However, the stock has been buzzing in the past few weeks and has often been locked in the upper circuit after sinking to a 52-week low of Rs 61.05 on April 9.

Biyani has been forced to scout for a buyer amid reports of mounting debt.

Credit rating agency Icra, which downgraded Future Corporate Resources Pt Ltd — a Future group promoter entity — to junk grade rating of BB+ in March, had said the total debt of the group’s listed companies had risen to Rs 12,778 crore as on September 30 last year.

In late March, the Bombay high court granted Biyani some reprieve by restraining IDBI Trusteeship from selling shares that he had pledged with it in order to recover dues of over Rs 650 crore.

Amazon question

The buyer of Future Retail will, however, have to contend with one formidable retailer: Amazon.

Jeff Bezos-owned Amazon already has a toehold in Future Retail by virtue of an indirect stake it holds in Future Retail under a complex deal negotiated last year.

In August 2019, Amazon bought a 49 per cent voting and non-voting shares of Future Coupons Pvt Ltd, a promoter group entity.

In December, Future Retail allowed conversion of previously issued warrants to FCPL into equity, giving Amazon an indirect entry to Future Retail Ltd.

According to the August agreement between FCPL and amazon.Com Investment Holding LLC, Amazon was granted a call option.

This call option allows Amazon to acquire all or part of the promoters’ shareholding in Future Retail and is exercisable between the third and tenth years, in certain circumstances, subject to applicable law.

Given that Reliance has ambitious plans to enter the e-retail space by using its vast telecom footprint through Jio and building a platform for small kirana stores, it will be hard to see how Amazon and Reliance will agree to remain partners in Future Retail, said industry observers.