The plan of debt-ridden Reliance Capital’s lenders to conduct a second round of auction has hit a roadblock, as bidders are apparently not inclined to another round under the insolvency resolution process, according to sources.

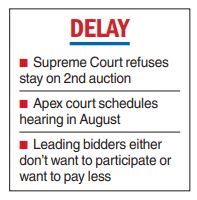

Meanwhile, the Supreme Court has listed the matter regarding the second auction for hearing in August.

The top court on March 20, 2023, admitted Torrent Investments’ — the highest bidder with a Rs 8,640 crore resolution plan — to appeal against the lenders’ decision to hold another round of auction.

However, the court refused to stay the second round of the auction.

The insolvency process of RelCap has been going on for more than 450 days, which is much longer than the statutory time limit of 330 days.

According to the sources, Torrent has recently conveyed to the lenders that it is not willing to participate in the second round of auction. The other bidder — IndusInd International Holdings Ltd (IIHL) of Hinduja Group — has also told the lenders that it wants to withdraw its revised bid of Rs 9,000 crore, which it had made after the auction process, and retain the old offer of Rs 8,110 crore in the first round of auction.

This has upset the Committee of Creditors (CoC) plan to conduct a second round of auction with a base price of Rs 9,500 crore to maximise the recovery from the RelCap resolution process.

In a related development, the sources said, a consortium of Cosmea Financial and Piramal, which had submitted binding bids for Reliance Capital in November, has written to the administrator, seeking a refund of their earnest money deposit (EMD) of Rs 75 crore each, as both the companies do not wish to further participate in the ongoing resolution process.

While the CoC can go ahead with the extended challenge mechanism, permitting lenders to go ahead with a second round of auction, the outcome of the auction will be subject to the final decision of the Supreme Court.