Debt-ridden firm Reliance Capital on Monday raised an objection to the proposed 33.12 per cent stake sale of Prime Focus Ltd (PFL) by Credit Suisse to PFL’s promoter group at Rs 44.15 per share.

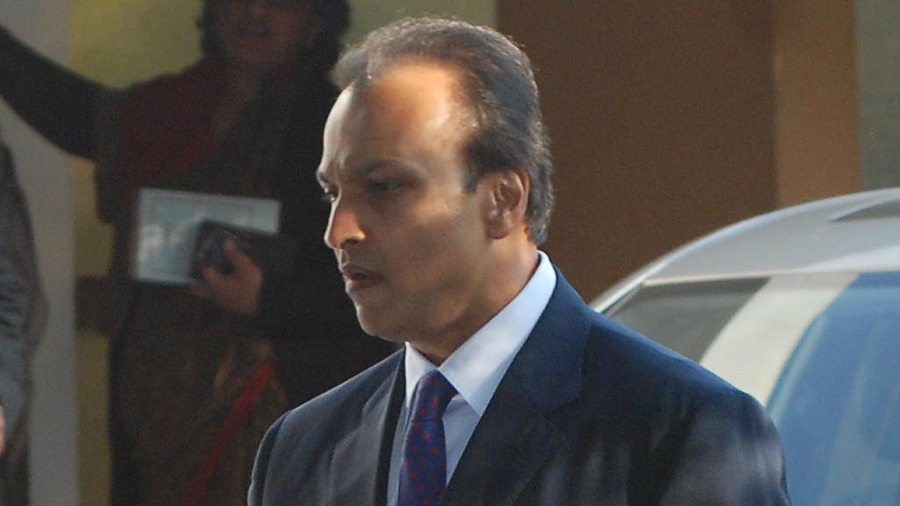

Anil Ambani’s Reliance Group company Reliance Capital termed the proposed transaction a blatant abuse of the purported rights by Credit Suisse under certain lending agreements with Rel Cap Group, the company said in a statement.

However, Reliance Capital did not share the details of the “blatant abuse of the purported rights”.

Reliance Mediaworks Financial Services Private Limited, an Rel Cap Group company, is one of the investors in PFL — promoted by Naresh Malhotra and Namit Malhotra. Reliance Mediaworks holds a 10.57 per cent stake in the PFL.

The company’s statement further alleged that the proposed sale is being attempted privately and clandestinely between two foreign entities, without any open, fair and transparent process being conducted to realise the true value of the shares and disregarding basic norms of conflict of interest.

“The proposed sale price is at a substantial altogether unwarranted discount to the intrinsic value of Prime Focus Ltd’s shares.

“The proposed transaction violates several laws, rules and regulations, including inter alia Sebi (Substantial Acquisition of Shares and Takeovers) Regulations, Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015, Foreign Exchange Management Act, 1999, and the extant RBI guidelines,” it said.

As legally advised, Rel Cap Group will seek all appropriate judicial and regulatory intervention to protect the interests of lenders and shareholders of PFL and Reliance Capital Ltd, it added.