The insurance regulator has streamlined its norms on management expenses after taking into consideration industry views in its revised draft of the rules in this area.

The regulator has also proposed to remove the caps on commission to agents and intermediaries that were proposed in the earlier draft.

Management expenses include operating expenses of insurance companies, commission to insurance agents and intermediaries and commission and expenses on reinsurance.

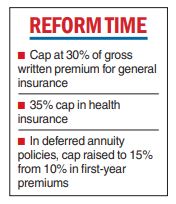

The regulator has now proposed a blanket cap on the expenses to the extent of 30 per cent of gross written premium in India for general insurance companies and 35 per cent for standalone health insurance companies. In the earlier draft in August, it was the lower of 30 per cent or the actual expense rate.

Such expenses are in the range of 20 per cent to 37.5 per cent at present. In motor insurance, for instance, the cap is 37.5 per cent for the first Rs 500 crore of total gross premium written annually, 32.5 per cent for the next Rs 250 crore and 30 per cent for the balance sum.

The additional allowable expenses within the overall expense cap now include expenses incurred towards government schemes such as Pradhan Mantri Suraksha Bima Yojana, Pradhan Mantri Jan Arogya Yojana and Pradhan Mantri Fasal Bima Yojana.

In the life insurance segment, there is also a change in the caps on annuity policies. Under the revised draft, on deferred annuity policies, there is now a cap of 15 per cent of all first-year premiums and 6 per cent of all renewal premiums received during the year. This was earlier 10 per cent and 4 per cent, respectively.

Like general insurers, the expenses of management for life insurers will also include expenses incurred towards underwriting Pradhan Mantri Jeevan Jyoti Bima Yojana.

“After careful consideration of the various comments received in the matter till date, amendments to the aforesaid regulations are proposed,” the Insurance Regulatory and Development Authority of India (IRDAI) said in a statement on Wednesday.

The regulator said while the reforms taken up are aimed at increasing insurance penetration and facilitating sustainable growth of the industry, the interests of the stakeholders, particularly policyholders, are also taken into consideration in the various measures undertaken.

Most insurance companies have indicated that they are within the limits prescribed by the regulator.

“We have examined the draft regulations which has come from the IRDAI. LIC has been, except a few lines of business, get well with it,” Dinesh Pant, appointed actuary and executive director, LIC had informed analysts at the earnings call.