Let us be lovers, we’ll marry our fortunes together

I’ve got some real estate here in my bag

Simon & Garfunkel

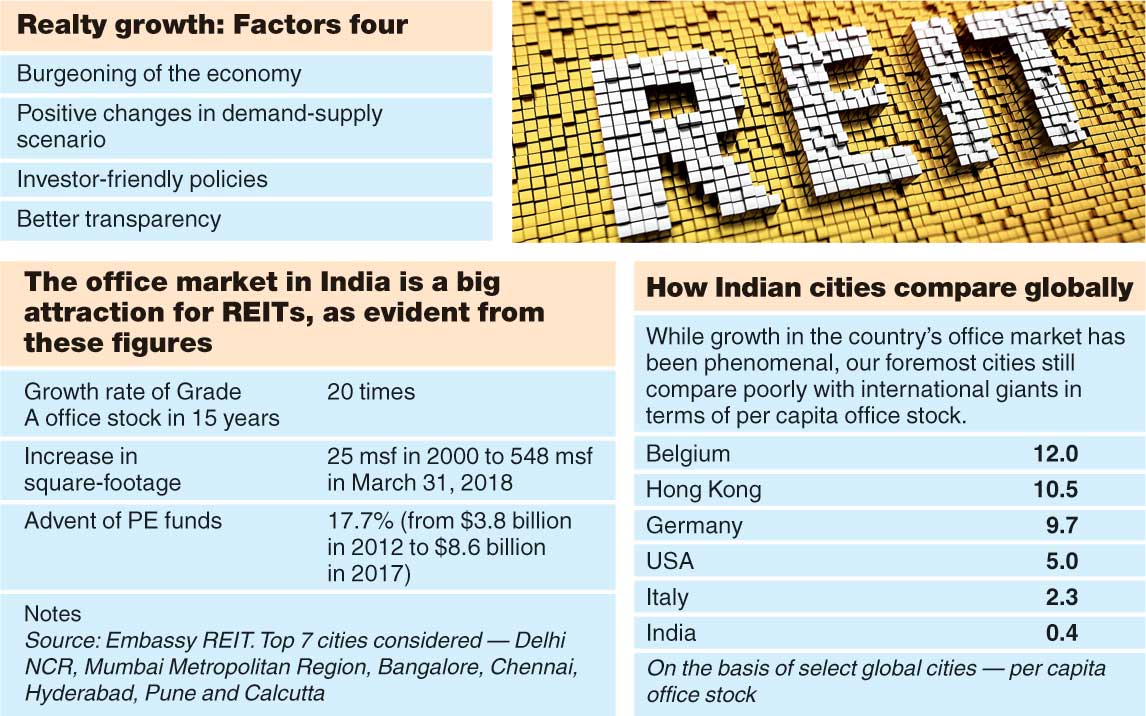

Back in 2014, real estate investors in India were an elated lot — the government had just outlined a framework for Real Estate Investment Trusts (REITs). Now, several years and many animated discussions later, the first of them has arrived this month.

Here we will consider the overriding aspects of what can easily emerge as a critical option for the investment fraternity in the days to come.

A REIT, armed with a pool of real estate assets, can typically earn from two sources: income by way of rent and appreciation of capital. The net results, derived after taking care of expenses, are aimed at rewarding investors. Distribution of gains over medium- and long-term holding periods, therefore, is a vital function of the REIT manager. Whether the latter has achieved success would be primarily determined by the quantum of gains so distributed.

Before we proceed further, let me quickly remind you that the country’s maiden REIT was launched recently, and there was limited room in it for ordinary investors (read: the retail variety) as well. Naturally, a number of big names in financial circles have figured in the list of anchor investors.

While we will not go into such details here, we will still seek an answer to that all-important question: what is the kind of money one can hope to make from one’s allocation to REITs? No easy fixes there, but in this connection, I would like to take you through a few pointers.

1. REIT can be treated as a good diversifier, a value-addition to one’s portfolio along with all other usual options — equity, debt and commodity.

2. Income derived from REIT allocation can fortify what is delivered by the other asset classes (such as dividend, interest or simply appreciation of capital).

3. There is plenty of risk involved; the realty market is by no means easy to handle. Projects can take long to fructify. Big chunks of unsold or unleased real estate (evident almost everywhere in modern-day India) are an obvious indicator.

It is incredibly difficult to predict the potential appreciation (or express the same as a single statistic) but chances are that a 7-10 per cent gain can be attained in line with projections. Now, I do understand that it is quite a range, but investors can hope to diversify via REITs and spread part of their risks over real estate assets.

(Telegraph)

Reality check

For real estate investors, a whole range of factors are currently working against serious appreciation of capital. The realty scenario has lately remained depressed, although the same cannot be uniformly said about commercial projects. Rental income streams from the latter are not too discouraging at the moment. I must also add that investors (in order to optimise their gains) should ideally hold such realty assets for sufficiently long periods.

There are loads of other stark realities as well, many of them beyond the control of investment managers. A REIT’s profitability, broadly speaking, will depend on the performance of its chosen sub-markets, which may well face adverse conditions. Also, any number of problems can arise in so far as tenants are concerned. Tenant leases, for example, bear the risk of non-renewal, non-replacement and even premature termination. Additionally, it may not be easy to lease vacant properties. The latter scenario will adversely impact the REIT’s income generation ability.

In this connection, an investor will do well to weigh the following before allocating:

- Does the REIT have a strong and diversified mix of tenants?

- What level of committed occupancy does it enjoy?

- What is the average lease period?

These and sundry other factors will determine an average REIT’s success in the days to come. Remember, there is no assurance or guarantee of any kind. Distribution of gains, if any, will be purely on the basis of “net distributable cash flows”.

REIT is an investment tool to leverage the growth in the realty market. It can be somewhat likened to a fund operated by an asset management outfit. This is after all a pool of capital to hold certain kind of assets, the latter being real estate. And one can stay invested to generate income from such assets.

But investing in REIT is a lot more than just that. What is, for instance, the tax liability for investors? The latter will record capital gains at the time of sale. Is the gain on such sale transaction a long-term gain (for three years or more, in this case) or a short-term gain?

Tax treatment

Any gain realised on units held for more than 36 months will attract capital gains tax at 10 per cent if STT has been paid on transaction. For STT-paid units held for less than 36 months the rate will be 15 per cent.

The writer is director of Wishlist Capital Advisors