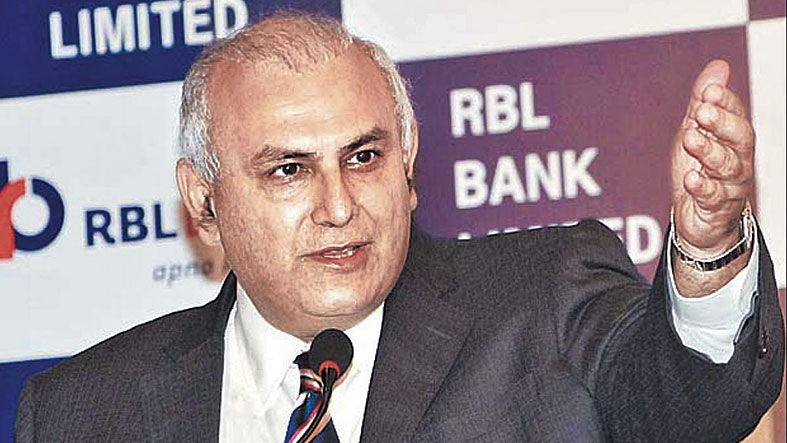

Vishwavir Ahuja, managing director and CEO of RBL Bank, has proceeded on leave after the Reserve Bank of India on Saturday appointed Yogesh K. Dayal as an additional director of the bank for a period of two years with effect from December 24.

The developments over the weekend cap a period of simmering tension between Ahuja and the banking regulator which had earlier turned down the bank’s request to grant him a three-year extension and instead directed that he could stay on till June 30 next year.

On Sunday, RBL Bank called a press conference where it announced that Rajeev Ahuja (no relation of Vishwawir) would take over as interim managing director and CEO.

Rajeev Ahuja. File photo

The bank also tried to allay apprehensions over the appointment of Dayal who is a chief general manager of RBI and has been heading the RBI’s Department of Communication. Earlier, he was also a director at J&K Bank.

Officials at the press conference said the bank and its management had the “full support of the RBI” and the latest developments were not a reflection on its fundamentals, or even triggered on account of any concerns over its advances, asset quality, governance standards or level of deposits.

Vishwavir Ahuja who has been with the bank for more than a decade, has apparently stepped down with immediate effect, six months before his tenure was to end. In June, the RBI had approved his re-appointment for a period of one year instead of the three years sought by the bank. He is unlikely to join the board again.

RBL Bank, however, continued to maintain that Vishwavir Ahuja had proceeded on medical leave.

Dayal’s appointment has set the dovecotes aflutter as the banking regulator usually takes such a course of action when it wants to enhance scrutiny in areas such as governance and asset quality or even assess the financial condition of a bank.

“Earlier, the RBI also did not give a three-year extension to Vishwavir Ahuja. The appointment of an additional director suggests that there are some things within the bank that the RBI is worried about,” said a senior banker who did not wish to be quoted. The RBI has not, however, stated the reasons for Dayal’s appointment.

In a letter written to Union finance minister Nirmala Sitharaman, the All India Bank Employees Association (AIBEA) had expressed concerns about the developments at the bank.

The AIBEA said given the background of the problems encountered by private sector lenders such as Yes Bank and Lakshmi Vilas Bank, the government should immediately intervene in the matter in the interest of RBL Bank’s depositors and consider necessary steps which include its merger with a PSU bank.

Speaking to newspersons in a conference call, Rajeev Ahuja said the bank is on solid ground and that it has surplus liquidity to of over Rs 15,000 crore . Rajeev asserted that the bank will post better profits in the December quarter than the preceding September quarter. He said the bank will stick to all the targets spelled out at the earning call in September, but conceded that microfinance lending is an area which requires more attention. “We need to up the game on service, governance, digital and risk areas.”

He claimed that the board of the bank had already chosen him as the successor to Vishwavir, and RBI-appointed additional director Yogesh Dayal also voted for his appointment as MD and CEO at a meeting held over the weekend. The central bank is fully behind the bank and its strategy, he added.

Vishwavir Ahuja was central to the transformation exercise at the bank and the new leadership will carry forward the same agenda, Rajeev said.

Asked about the RBI action, which has a few precedents, Rajeev said the central bank would have its own specific reasons to make such an appointment, but declined to share any details.

To a question on what he feels will be the focus areas for RBI, Rajeev pointed to compliance and risk management as the possible priorities but was quick to add that these are the same as the bank's own internal interests as well.