The Reserve Bank of India (RBI) has refused to give Yes Bank managing director and CEO Rana Kapoor an extension beyond January next year and has asked the private sector lender to appoint a new chief by February 1, 2019.

“The RBI has reaffirmed that a successor to Rana Kapoor, should be appointed by February 1, 2019,” the bank said in a filing to stock exchanges on Wednesday.

The private sector lender further said that it had already appointed a search and selection committee to pick Kapoor’s successor and the panel is targeting to complete the recruitment process latest by mid December.

The committee is headed by independent director Brahm Dutt.

Yes Bank had earlier said it would seek the RBI’s approval to extend Kapoor’s term beyond January since it needed more time to identify and groom a successor, after the central bank trimmed his term despite shareholders giving a nod to extend it for three more years.

The Yes Bank board had felt that, given the role played by Kapoor since the inception of the lender in 2004 and the lengthy process of finding a suitable successor, he should be given time in his current position beyond January 31, 2019.

It had, therefore, requested the RBI that Kapoor be granted an extension at least till April 30, 2019 to finalise the audited financial statements for the year ending March 31, 2019.

The lender was also keen on Kapoor continuing as MD & CEO till September next year, subject to RBI’s approval, when the statutory annual general meeting is scheduled to be held.

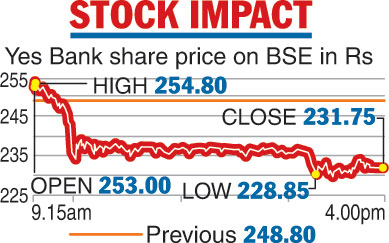

The Yes Bank scrip ended about 7 per cent lower on Wednesday following broad weakness in financial stocks.

Yes Bank said its MD & CEO will be fully guided by its board of directors, the RBI and other relevant stakeholders.

The bank further pointed out that its search & selection committee has mandated Korn Ferry to assist it in evaluating both internal and external candidates and make suitable recommendations to the board of directors within the stipulated timelines for RBI's final approval.

On the Bombay Stock Exchange, the scrip settled at Rs 231.75, which marked a drop of 6.85 per cent or Rs 17.05, from its previous close.