The Reserve Bank of India (RBI) stunned the Street by raising the policy repo rate by 40 basis points to 4.40 per cent after an unscheduled meeting of the policymakers on May 2 and May 4 — in an attempt to quell inflation which shot up to a 17-month high of 6.95 per cent in March and is expected to remain elevated because of firm food and crude oil prices.

“The wolf of inflation is here. I think this rate hike was needed and I am glad that they have acted intra-market and intra policy,” Uday Kotak, MD and CEO of Kotak Mahindra Bank said.

The repo rate hike is the first revision in two years and the first increase in almost four years. In March 2020, the RBI had cut the repo by 75 basis points from 5.15 per cent to 4.40 per cent.

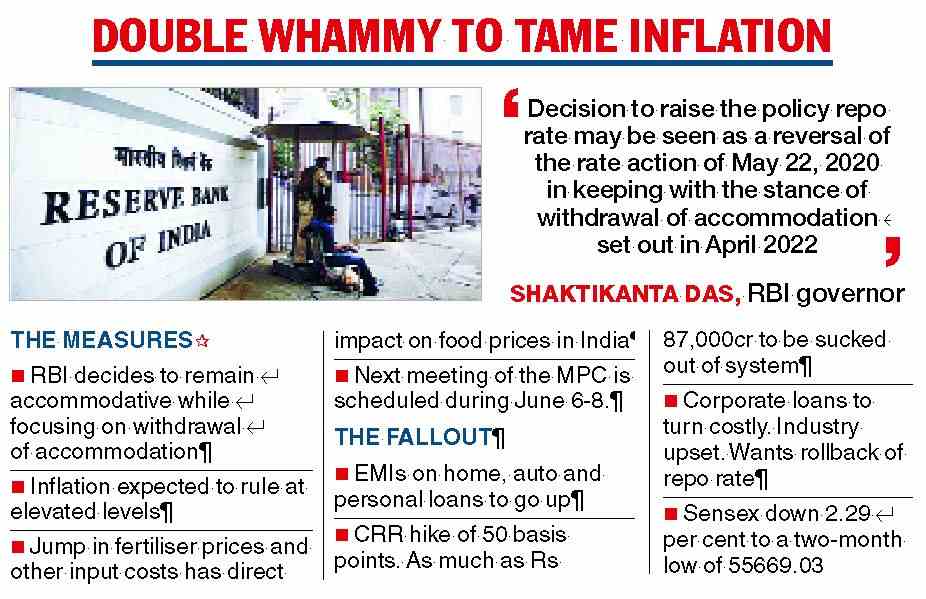

At the same time, the RBI raised the cash reserve ratio by 50 basis points to 4.5 per cent from the week beginning May 21. This will suck out liquidity worth Rs 87,000 crore.

The move caught the markets completely by surprise — the 10-year bond yield jumped to 7.42 per cent, its highest since May 2019, but then settled at the close at 7.38 per cent. The rupee wobbled against the dollar before closing at 76.4125 per dollar.

“If inflation remains elevated at these levels for too long, it can de-anchor inflation expectations which, in turn, can become self-fulfilling and detrimental to growth and financial stability,” RBI governor Shaktikanta Das said.

“Today’s move is perhaps instigated by the upcoming April inflation print, which could come in higher than expected — we currently estimate a print of 7.6 per cent,” Abheek Barua,chief economist at HDFC Bank, said.

The revision in the repo rate will make EMIs dearer, although depositors will benefit as FD rates will go up. “The whole structure of interest rates will harden, implying that loans will be costlier and fixed deposits attractive,” Prasenjit Basu, chief economist at ICICI Securities, said.

The RBI has been for falling behind the curve in fighting inflation which has stayed above the upper bound of its 2-6 per cent band for three months in a row. Observers said that the piercing increase in the repo rate has showed that the critics were right as the apex bank played catch-up with one big hike.

“We believe the terminal repo rate in this cycle will be 5.5 per cent by mid-2023. This will leave the repo rate somewhat higher than 5.15 per cent where it was on the eve of the pandemic,” Pranjul Bhandari, who is chief economist at HSBC, said.

“A huge bond supply in FY23 will require the RBI’s invisible hand, implying the return of tactical open market operations, especially as the balance of payments deficit could soar to $ 50 billion in FY23,” Madhavi Arora, lead economist, Emkay Global Financial Services, said.

“The RBI may neutralize this partly with more CRR (cash reserve ratio) hikes if it intends to bluntly reduce banking liquidity,” she said.

This sudden move caught the financial markets by complete surprise as it was largely anticipated after the April meeting, that the six member MPC will increase the repo rate by 25 basis points at its next scheduled meeting in June. The expectation was that it will follow it up with measured hikes (of up to 25 basis points each) to not affect the economy’s applecart.

However, after today’s decision, economists feel that the June meeting will see the RBI raising the repo rate again by up to 50 basis points. They feel that the policy rate will be increased to the pre-pandemic level of 5.15 per cent in multiple revisions that could stretch till 2023, if inflation remains elevated.

In a televised address, RBI Governor Shaktikanta Das cited the inflation challenge when he said that globally, prices are rising alarmingly, and that geo-political tensions are pushing inflation to their highest levels in the last 3-4 decades in major economies while moderating external demand.

Das added that in response to the pandemic, the monetary policy had shifted gears to an `ultra-accommodative mode’, with a large reduction of 75 basis points in the policy repo rate on March 27, 2020 followed by another reduction of 40 basis points on May 22, 2020. Therefore, the latest MPC decision to raise the policy repo rate by 40 basis points to 4.40 per cent may be seen as a reversal of the rate action of May 22, 2020 and this is in line with the announced stance of `withdrawal of accommodation’ that was made in April.

The RBI Governor pointed out that the economy is now at a crucial juncture and the central bank will remain steadfast in its commitment to contain inflation and support growth. Stressing the importance of fighting inflation, he said that it must be tamed to keep the Indian economy resolute on its course to sustained and inclusive growth.

``The biggest contribution to overall macroeconomic and financial stability as well as sustainable growth would come from our effort to maintain price stability…As several storms hit together, our actions today are important steps to steady the ship. We remain watchful of incoming data and information to constantly reassess the situation and the outlook. We will be proactive and flexible in our approach’’, he added.

Here, the MPC said that apart from high crude oil prices, factors like rising global commodity prices, shortages due to output losses, export restrictions by key producing countries, renewed lockdowns and supply chain disruptions due to resurgence of Covid-19 infections in major economies, impart significant upside risks to the inflation trajectory that was set out in its April statement. The panel had then forecast retail inflation to come at 5.7 per cent in this fiscal.

According to the panel, the inflation outlook warrants an appropriate and timely response through resolute and calibrated steps to ensure that the second-round effects of supply side shocks on the economy are contained and long-term inflation expectations are kept firmly anchored.

``International crude oil prices continue to hover above $ 100 per barrel and this is prompting pass-through to domestic pump prices. The risks of unprecedented input cost pressures translating into yet another round of price increases for processed food, non-food manufactured products and services are now more potent than before. This could strengthen corporate pricing power if margins get squeezed inordinately’’, Das said while reiterating that the strengthening of inflationary impulses along with the persistence of adverse global price shocks would put more pressure to the inflation forecast given in April.

Reacting to the sudden RBI decision, Suvodeep Rakshit, Senior Economist, Kotak Institutional Equities said that the combination of 40 basis point hike in repo rate and 50 basis point increase in the CRR is an attempt by the RBI to pre-empt the rising inflationary pressures and be ahead of the curve even as there is also a risk of inflation remaining above 6 per cent for three consecutive quarters which will be its failure to adhere to the inflation targeting mandate.

``The surprise was also on the CRR hike which indicates the RBI’s intent on withdrawing liquidity at a sharper pace… Rates across the curve will reprice factoring in a markedly more hawkish RBI. We continue to expect another 75-100 basis points of consecutive repo rate hikes in the upcoming policy meetings’’, he added.