The Reserve Bank of India will come out with a discussion paper on the reasonableness of charges on transactions through the digital mode.

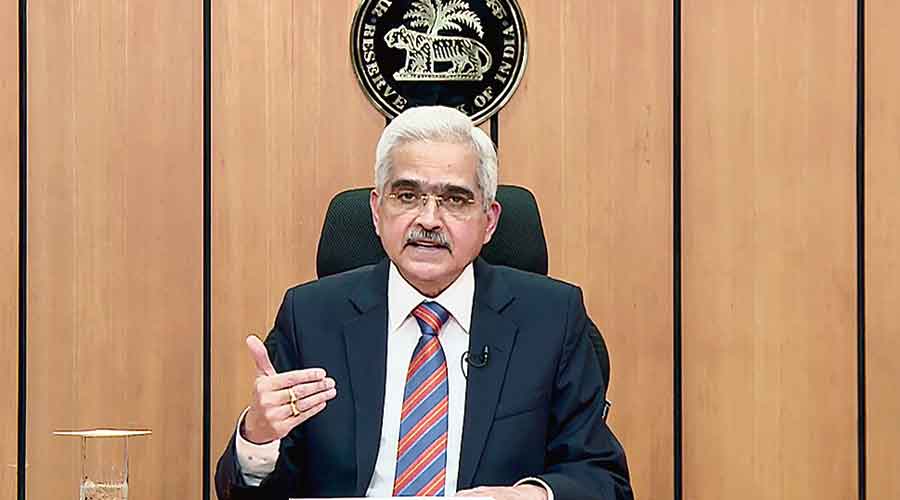

RBI governor Shaktikanta Das said there have been some concerns on the charges incurred by customers for digital payments through credit cards, debit cards, prepaid payment instruments (cards and wallets) and unified payments interface (UPI).

Entities involved in providing digital payment services incur costs, which are generally recovered from the merchant or customer.

While there are advantages and disadvantages of customers bearing these charges, they should be reasonable and should not become a deterrent in the adoption of digital payments, he added.

To take a comprehensive view of the issues involved, he said it is proposed to issue a discussion paper, which will cover all aspects related to charges involved in various channels of digital payments.

The paper will also seek feedback on convenience fee and surcharging.

UPI benefits

The Reserve Bank of India has raised the transaction limit under unified payments interface (UPI) for investing in initial public offering (IPOs) and government securities through the Retail Direct Scheme to Rs 5 lakh from Rs 2 lakh.

Observers said this move would not impact retail investors as they can only invest up to Rs 2 lakh. High net-worth individuals may benefit as they can invest up to Rs 5 lakh.

Das said the central bank will soon announce details of taking the UPI application to the 44 crore feature phone users in India.