The Reserve Bank of India, criticised for its failure to stop demonetisation, is slowly standing up to political and corporate pressures to lay new laws on banking and protect its turf as a regulator.

From ending the tenure of bank CEOs who wrongly reported bad loans and resisting the government’s bid to take away its powers in settling bank payments to deciding how to deal with lenders going sick — the apex bank is making its presence felt strongly.

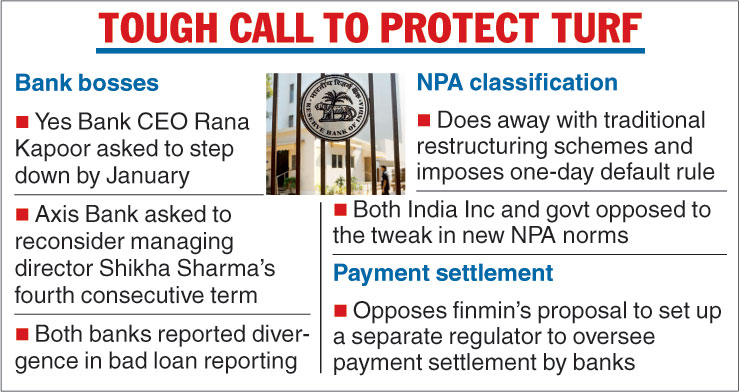

Last week, the central bank showed its resolve to end the complacency over shoddy lending by banks when it decided to end Rana Kapoor’s tenure as the chief executive of Yes Bank, one of India’s largest private sector banks.

Kapoor had founded Yes Bank in 2004. He has been asked to step down by January next year.

Earlier, the RBI had asked Axis Bank to reconsider its decision to grant a fourth term to its managing director and CEO Shikha Sharma. The bank has chosen Amitabh Chaudhry of HDFC Standard Life Insurance to replace Sharma.

The Telegraph

Bad loan decisions

The tough decisions follow the RBI’s orders last year to banks to come clean on the difference between the bad loans reported in their results and as assessed in central bank reviews. Yes Bank later reported a discrepancy of more than 300 per cent, one of the highest in the industry, while Axis reported a 26 per cent difference.

The RBI also had to intervene in the affairs of ICICI Bank whose CEO Chanda Kochhar is facing probes on loans given by the bank after a whistleblower had alleged conflict of interest in the manner in which the loans were given. Kochhar is currently on leave from the bank.

Earlier this year, the RBI stood up to intense pressure from both the government and corporate circles to dilute a key circular it brought out in February 2018 on bad loans. Besides doing away with the traditional restructuring schemes, the RBI specified norms that require banks to classify a loan as non-performing even if there is a single day’s delay in repayment.

This month, the regulator opened up a front against the finance ministry by disagreeing with it vehemently over its proposal to set up an independent Payments Regulatory Board of India, which many fear is designed to strip the RBI of its powers.

Settlement regulator

The setting up of the board has been suggested as part of a draft Payment and Settlement System Bill 2018 by a committee, headed by economic affairs secretary Subhash Chandra Garg. While opposing the move, the RBI has pointed out that central banks all over the world enjoyed the power of supervision over payment transfers and settlements by banks as this was essential to ensure smooth and orderly banking.

The committee’s report comes after the RBI demanded that it be given more powers to control PSU banks in the wake of the Nirav Modi scam, which saw state-run lender Punjab National Bank losing around Rs 14,000 crore through a fraudulent settlement.

RBI governor Urjit Patel had told a parliamentary standing committee of finance in June that the central bank had “inadequate” control over state-run banks, flagging the issue of dual control over PSU banks by the government, on the one hand, and the RBI on the other.

Analysts said there was significant operational control exercised by the finance ministry, often bypassing bank boards and the RBI.

Last year, the RBI and the Centre were at loggerheads over moves to curb the central bank’s powers of determining how to deal with a bank which went bust. The now-withdrawn Financial Resolution and Deposit Insurance Bill had suggested setting up a “resolution corporation” with representatives from the RBI, Sebi and the insurance regulator, which would determine the financial health of a bank and recommend remedial measures for those on the verge of going bust.