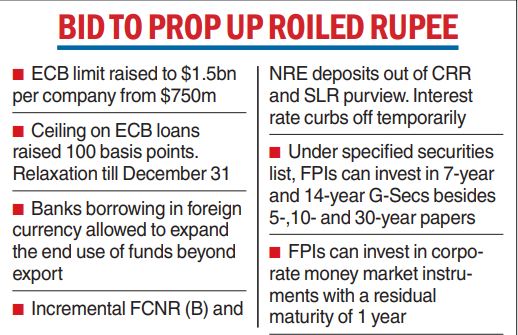

The Reserve Bank of India (RBI) on Wednesday adopted a slew of measures to shore up forex inflows and arrest the rupee’s fall. The central bank doubled the borrowing limit under the external commercial borrowing (ECB) route, removed the fetters around Foreign Currency Non-Resident Bank [FCNR(B)] and NRE deposits and allowed foreign portfolio investors (FPIs) to invest more in debt including short-term corporate paper.

The measures come at a time the domestic currency has slipped below 79 and is trading at record lows. The RBI allowed corporates to raise more money through ECBs. The limit under the automatic route for ECBs has been raised to $1.5 billion per company from $750 million.

The all-in cost ceiling — currently at 450 basis points over the benchmark rate — is being raised 100 basis points. This relaxation will be available up to December 31. Rules for banks who undertake overseas foreign currency borrowing (OFCB) have been relaxed.

Previously, the funds were meant only to finance exports. The end-use purpose has now been enlarged, which is expected to increase its appeal too. The RBI has made it more attractive for banks to raise interest rates on FCNR (B) and NRE deposits by exempting them from the purview of cash reserve ratio (CRR) and statutory liquidity ratio (SLR) requirements.

With effect from the reporting fortnight beginning July 30, 2022, incremental FCNR(B) and NRE deposits will be exempt from the maintenance of CRR and SLR. This relaxation will be available for deposits mobilised up to November 4, 2022.

Interest rate curbs on these two deposits were also removed temporarily. At present, interest rates on FCNR(B) deposits are subject to ceilings of Overnight Alternative Reference Rate (ARR- an alternative to Libor) for the respective currency plus 250 basis points for deposits of 1 year to less than 3 years maturity and a limit of ARR plus 350 basis points for deposits of 3 years and above and up to 5 years maturity.

In NRE deposits, banks cannot offer higher interest rates than those offered on comparable domestic rupee term deposits. The RBI on Wednesday said that banks can raise fresh FCNR(B) and NRE deposits without reference to the current regulations on interest rates, with effect from July 7, 2022.

This relaxation will be available for the period up to October 31, 2022. The banking regulator also took another step to improve inflows from FPIs. Under the fully accessible route (FAR) for investment, all central government securities with 5-year, 10-year and 30- year tenors are categorised as“specified securities”.

This list has now been widened to include the 7-year and14-year G-secs. Under the medium-term framework route (MTF), foreign portfolio investors can invest in corporate debt instruments with a residual maturity of at least one year. These investors have now been given a limited window till October 31 during which they can invest in corporate money market instruments.