The Telegraph

Multiple options

The ECB framework allows permitted resident entities to borrow from overseas markets in various forms that include loans, fixed rate bonds or non-convertible, optionally convertible or partially convertible preference shares and debentures, apart from foreign currency convertible bonds (FCCBs).

Under the framework, ECBs can be raised either under the automatic route or under the approval route.

For the automatic route, the cases are examined by the authorised dealer (AD) banks while under the approval route, the borrowers have to send their requests to the RBI through their dealers.

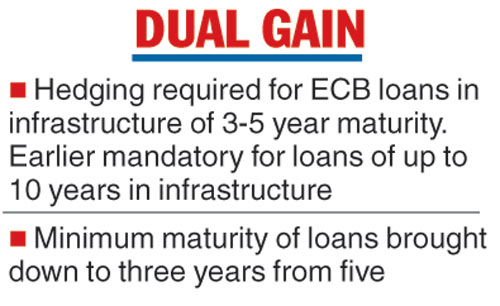

The Reserve Bank of India (RBI) took another step to ease the standoff with the government when it relaxed the mandatory hedging requirement for infrastructure loans of less than 10 years.

Simultaneously, the central bank paved the way for infrastructure firms to raise more funds when it reduced the minimum average maturity requirement for external commercial borrowings (ECBs) to three years from five years.

This move from the central bank comes at a time differences with the government over various issues have come out in the open.

The Centre has invoked Section 7 (1) of the RBI Act to seek consultations with the banking regulator on these issues.

While these matters are expected to come up in the board meeting of the RBI on November 19, one of the demands made by the government was the central bank to relax the mandatory hedging requirements of infrastructure loans of below 10 years.

The RBI on Tuesday said in a notification that in consultation with the government, it has decided to make certain changes to the ECB framework. Accordingly, it has reduced the average maturity requirement from the current 10 years to 5 years for exemption from mandatory hedging provision.

This will apply to borrowers in the infrastructure space, it added.

ECBs with minimum average maturity period of 3 years to 5 years in the infrastructure space will have to meet 100 per cent mandatory hedging requirement.

Further, the central bank brought down the minimum average maturity requirement for ECBs raised by infrastructure firms to three years from five years, irrespective of the amount of borrowing.