The Reserve Bank of India (RBI) on Friday adopted a more hawkish stand than market expectations as it raised the policy repo rate 50 basis points to 5.40 per cent in the fight against inflation which remains at ``unacceptably high levels’’. The aggressive action follows a rash of tightening measures by central banks in advanced economies in response to surging inflation.

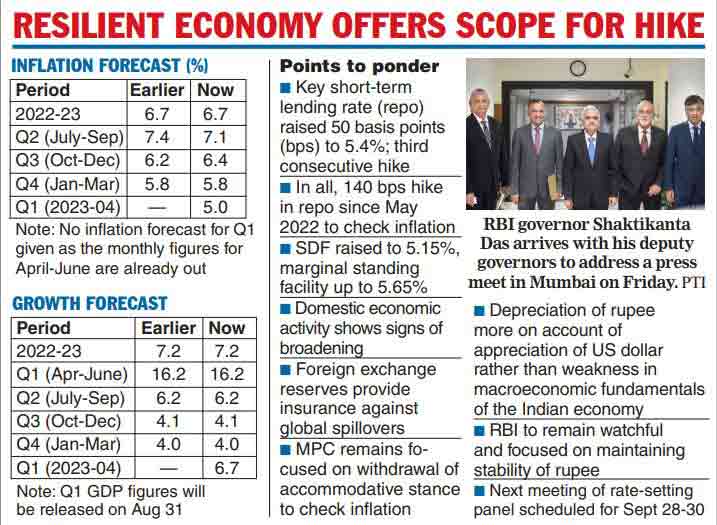

While some of these economies are facing the grim prospect of recession, a relatively resilient Indian economy gave the RBI the space to deliver another interest rate hike. This is the third consecutive hike by the monetary policy committee (MPC) of the RBI since May taking the overall increase to 140 basis points with retail inflation well above the RBI tolerance level of 4-6 per cent.

The repo rate at 5.40 per cent was last seen in August 2019. The effective rate hike is higher at 180 basis points if one includes the standing deposit facility (SDF) rate that was introduced in April at 40 basis points higher than the reverse repo rate. The RBI had introduced SDF to absorb liquidity without exchange of collateral such as government securities.

RBI governor Shaktikanta Das told reporters that in an ocean of high turbulence and uncertainty, the Indian economy is an island of macroeconomic and financial stability. He added that the economic growth is resilient despite two black swan events — the Ukraine war and US-China standoff on Taiwan — happening one after another and multiple shocks. ``At this point in time, there are signs that the CPI (consumer price index) inflation has peaked and it is expected to moderate going in the fourth quarter of this year (fiscal) and the first quarter of next year (fiscal).”

“But inflation still remains at uncomfortably or unacceptably high levels and therefore monetary policy has to act, and there are also several uncertainties that are clouding the outlook.”

“That is why the monetary policy action of 50 basis point hike. Steps have to be taken to contain inflation and inflation expectations and the resilient economic activity gives us the space to act,’’ Das said.

Following the hike in the repo rate, SDF has been revised to 5.15 per cent and the marginal standing facility (MSF) to 5.65 per cent. SDF and MSF are the lower and upper ends, respectively, of the interest rate corridor. While Das refused to give any guidance on the interest rate trajectory, economists feel the RBI will continue with the inflation fight at least till the end of this calendar year. However, they differ on the amount of hikes. Abheek Barua, chief economist and executive vice-president, HDFC Bank, feels the RBI made a “textbook policy’’ announcement as the hike is frontloaded and aggressive in response to inflation.

Barua expects the repo rate will be taken up to 5.75 per cent by the end of the year. Radhika Rao, executive director and senior economist at DBS Group Research, said the RBI has now unwound the accommodative rate moves undertaken during the pandemic. “In our view, this necessitates the MPC to continue to incrementally tighten policy in the rest of 2022-23.

We maintain our call for at least another 75 basis points hikes by March 2023, subject to inflation nearing its peak in the third quarter of 2021-22 and gradually easing below 6 per cent,’’ she noted. While all the six members of MPC voted for the 50 basis point hike in repo rate, Jayanth Varma expressed reservation on the panel’s stance of withdrawal of accommodation. Varma has long been calling for a change of stance to neutral.

Ombudsman scheme to cover CICs

The Reserve Bank on Friday decided to expand the scope of the internal ombudsman framework by including Credit Information Companies (CICs) with a view to strengthening the grievance redressal system. The RBI-Integrated Ombudsman Scheme has improved customer grievance redressal mechanism.

The turnaround time of redressal under RB-IOS has declined considerably, RBI said in its statement on developmental and regulatory Policies. “To strengthen the internal grievance redress by CICs themselves, it has been decided to mandate CICs to have their own Internal Ombudsman framework,” RBI governor Shaktikanta Das said. The RB-IOS 2021 covers Regulated Entities such as scheduled commercial banks including urban co-operative banks, NBFCs and non-scheduled primary co-operative banks with deposit size of Rs 50 crore and above.