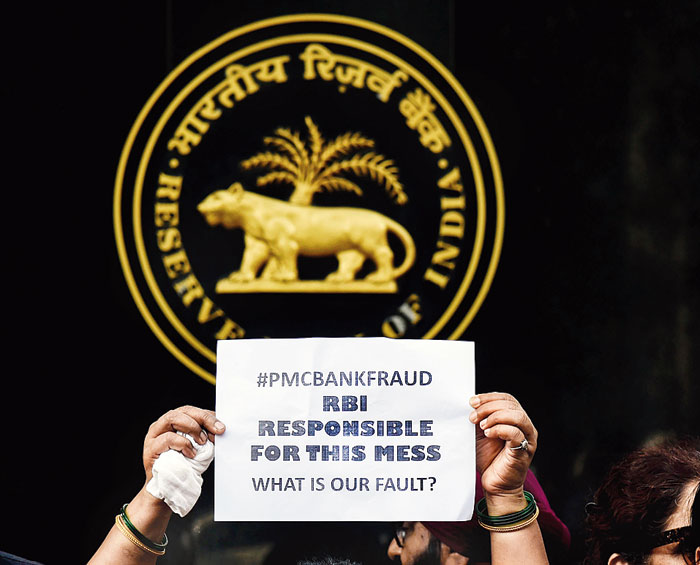

Finance minister Nirmala Sitharaman on Saturday tried to reach out to the account holders of troubled Punjab and Maharashtra Cooperative Bank (PMC) by stating that the RBI would treat their concerns as top priority.

Amid concerns over the long-term freeze on withdrawal of funds from the bank, the RBI had to thrice raise the withdrawal limit, which now stands at Rs 25,000, following demands by angry customers.

“Spoken to the governor of the RBI on the PMC Bank matter. He assured me that clients and their concerns will be kept on top priority. I wish to reiterate that Finmin India will ensure that customers’ concerns are comprehensively addressed. We understand the justified worries of the customers,” the finance minister, who has also come under criticism from PMC Bank customers, said in a tweet.

PMC Bank’s bad health can be attributed to its exposure to near-bankrupt realty player HDIL, to which it has lent over 70 per cent of its Rs 9,000 crore in advances.

Earlier this week, during a media interaction, Sitharaman had said, “The finance ministry may have nothing to do with it (PMC bank matter) directly because the RBI is the regulator. But from my side, I’ve asked the secretaries of my ministry to work with the rural development ministry and the urban development ministry to study in details as to what is happening.”

Secretaries from the department of financial services and economic affairs will be meeting a deputy governor of the RBI soon to look into the “shortcomings” of the functioning of multi-state co-operative banks and see if any amendments can be made to the laws, she had said.

“They will discuss legislative steps needed to prevent such incidents from happening and empower the regulator better,” she had said.

The government will bring in a legislation to this effect in the winter session of Parliament, she had said.

Joy Thomas, the former managing director of PMC Bank, is in police custody. The bank has accused its management of concealing bad loans, leading to a loss of at least Rs 4,300 crore, and camouflaging its financials. Others to be arrested are the bank’s former chairman Waryam Singh and the former senior executives of HDIL — Sarang Wadhwan and Rakesh Wadhwan.