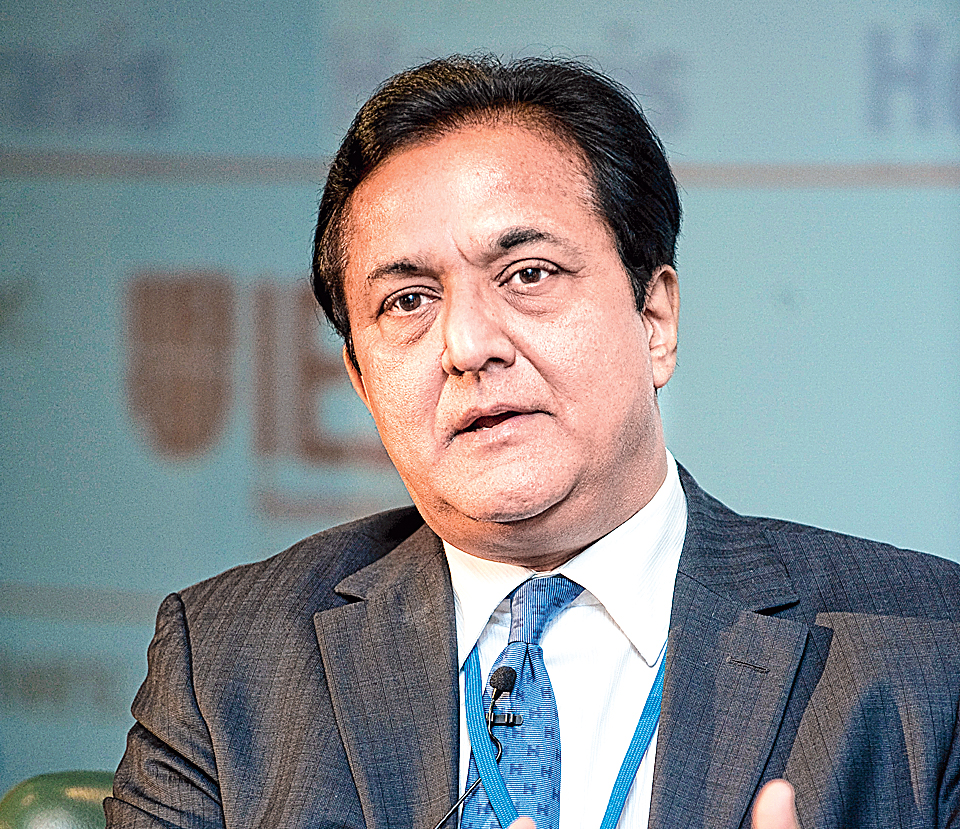

The Reserve Bank of India had cited “serious lapses” in governance and a “poor compliance culture” at Yes Bank as reasons for its “regulatory discomfort” in allowing Rana Kapoor to head the private sector lender, sources said, citing a communication from the central bank.

Asking the Yes Bank board to appoint a successor to Kapoor latest by February 1, 2019, the RBI, in its letter dated September 17 to the lender's then chairman Ashok Chawla, had said the bank had displayed “highly irregular” credit management practices.

While Chawla, who resigned from the board earlier this month, was not reachable for comments, an e-mail sent to the RBI on the matter remained unanswered.

Despite repeated queries from PTI, Yes Bank did not comment on specific “concerns” raised by the RBI in its letter, saying that “any communication between the bank and its regulator (RBI) are secret, confidential and privileged”.

Sources close to the bank, however, said several of the concerns raised by the RBI had already been addressed and the same were reflected in its communication. They also claimed that the bank had complied with all corrective actions sought by the RBI, most of them having been done before the September 17 missive.

In a BSE filing on September 19, Yes Bank had said it was intimated by the RBI vide a letter dated September 17 that Kapoor may continue as the MD and CEO till January 31, 2019, but did not disclose any further details on the RBI’s communication.

Sources citing the RBI’s letter said the central bank also wrote about its “concern” relating to a steep hike in Kapoor’s remuneration by the board while seeking a three-year reappointment, saying it was in defiance of its earlier recommendations to bank boards to cut CEO bonuses.

The RBI said these events reinforce its “concern and regulatory discomfort with the role of the incumbent MD & CEO in the governance, management and superintendence of the Yes Bank”. PTI