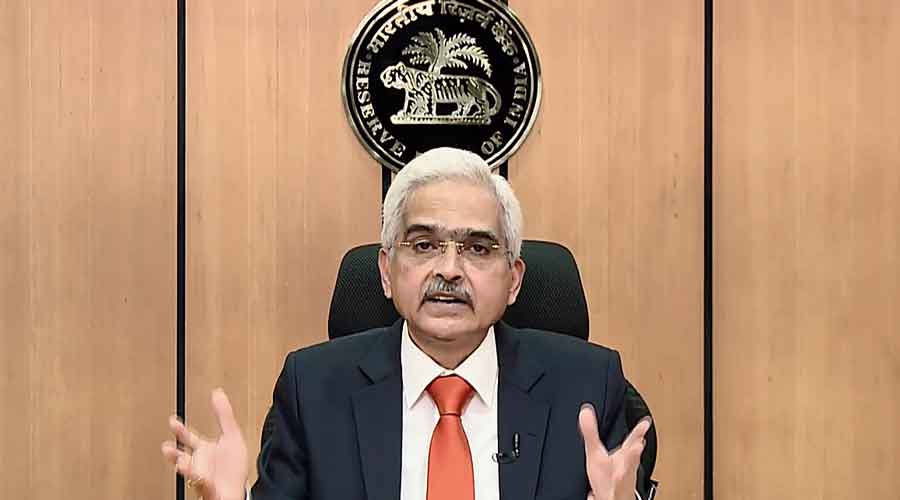

Exuding confidence that the price situation will gradually improve in the second half of the current fiscal, RBI governor Shaktikanta Das on Saturday said the central bank would continue to take monetary measures to anchor inflation with a view to achieving strong and sustainable growth.

Inflation is a measure of the trust and confidence that the public reposes in the economic institutions of the country, Das said while speaking at the inaugural Kautilya Economic Conclave.

“Overall, at this point of time, with the supply outlook appearing favourable and several high-frequency indicators pointing to resilience of the recovery in the first quarter (April-June) of 2022-23, our current assessment is that inflation may ease gradually in the second half of 2022-23, precluding the chances of a hard landing in India,” the governor said.

Noting that price stability is key to maintaining macroeconomic and financial stability, he said the central bank will undertake measures for preserving and fostering macroeconomic stability.

“While factors beyond our control may affect inflation in the short run, its trajectory over the medium-term is determined by monetary policy. Therefore, monetary policy must take timely actions to anchor inflation and inflation expectations so as to place the economy on a strong and sustainable growth pedestal.

“We will continue to calibrate our policies with the overarching goal of preserving and fostering macroeconomic stability,” he said.

Das noted that the Monetary Policy Committee (MPC) in its April and June meetings revised the projection of inflation for 2022-23 in two stages to 6.7 per cent, taking stock of the evolving developments and with inflation pressures getting generalised.

About three-fourths of the revision in June was on account of geopolitical spillovers to food prices, he said, adding the MPC also decided to increase the policy repo rate by 40 bps and 50 bps in May and June, respectively. This was on top of the 40 basis points (bps) effective rate hike through the introduction of the Standing Deposit Facility (SDF) at 3.75 per cent.