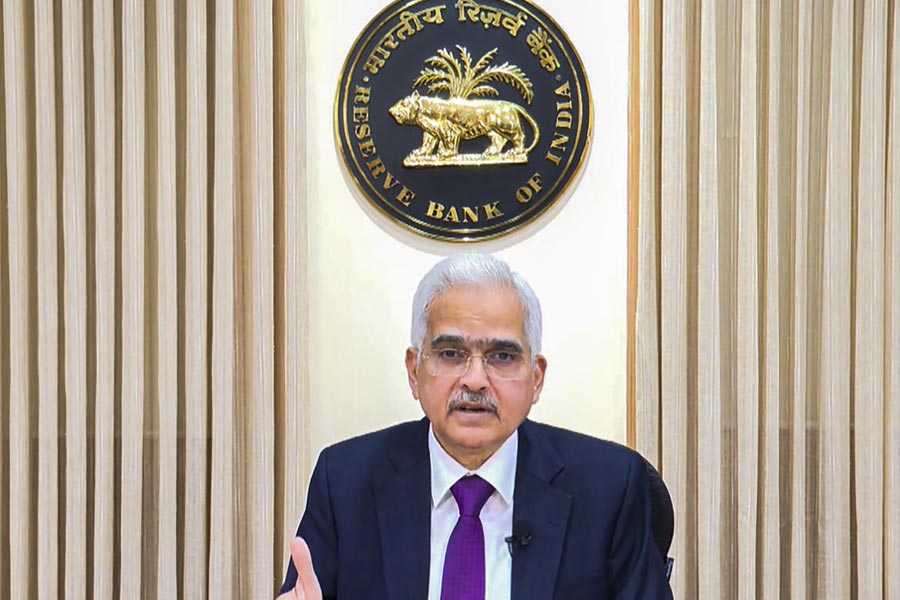

Reserve Bank of India governor Shaktikanta Das has become wary of inflation all over again.

Less than three months ago, he had sparked hopes of an early interest rate cut after flippantly remarking at a post-monetary policy press conference that the elephant that had been in the room for close to two years may have sauntered back to the jungle and would, hopefully, stay there.

Retail inflation is projected to fall to 4.5 per cent by the close of this fiscal. In May, inflation had tumbled to a 12-month low of 4.75 per cent.

But after that droll comment in April, the furrows on Das’s brow have deepened despite the cooling of inflation and he isn’t looking to cut interest rates anytime soon.

Das struck a hawkish stand at an event on Tuesday when he said that it was “too premature” to change the monetary policy stance, adding that the central bank wanted to avoid any sort of “adventurism” on rates.

The cautious tone comes at a time some of the global central banks have begun to cut rates, with the US Federal Reserve expected to reduce borrowing costs at least once later this calendar year.

On June 7, the monetary policy committee (MPC) of the RBI retained the policy repo rate at 6.50 per cent. However, two external members — Ashima Goyal and Jayanth R. Varma — voted to reduce the policy repo rate by 25 basis points and change the policy stance to neutral from withdrawal of accommodation.

With some among MPC proposing cuts and inflation moderating, there were expectations that the Indian central bank would start bringing down interest rates by October, though any cut will be a shallow one.

While Das has on numerous occasions said the last mile of disinflation is proving to be slow, the statement made on Wednesday would indicate the RBI would wait for a durable moderation in inflation to the target of 4 per cent before considering a rate cut.

“Inflation is moderating but at a very slow pace. We are fairly confident that the downward journey of inflation will continue. We are optimistic that the inflation will continue to moderate, but the pace seems to be very very slow and it is so worldwide,” Das said.

“If you look at the numbers even in advanced economies the pace of disinflation is very slow. In advanced economies we are also coming across instances where inflation has mildly gone up.’’

Das pointed to uncertainties surrounding food inflation which remains high at 8 per cent.