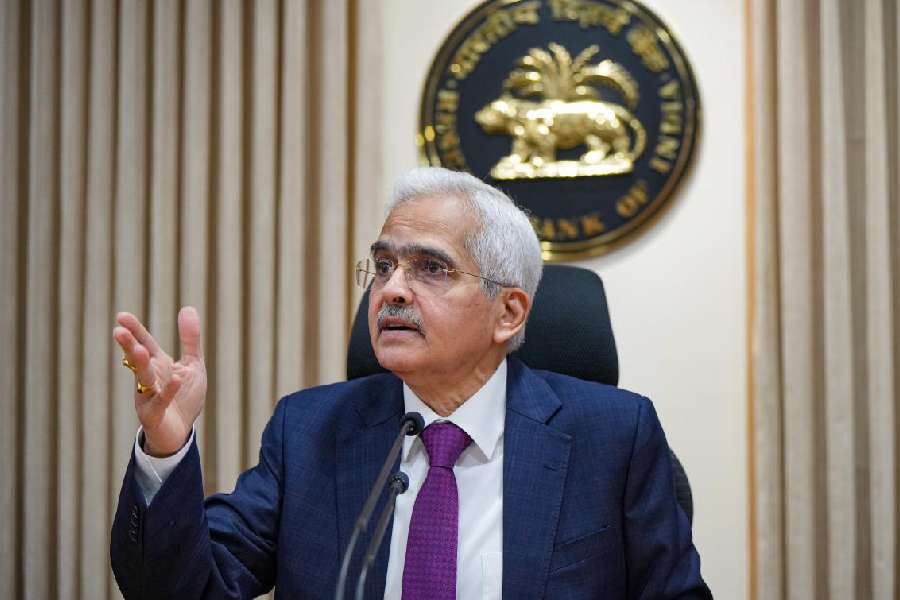

Reserve Bank of India (RBI) governor Shaktikanta Das on Monday called for greater participation of Indian banks in the rupee derivatives market, both domestic and offshore while being prudent.

Das’s call to banks follows a clampdown by the RBI on the market for exchange-traded currency derivatives (ETCDs) that have seen their trading volumes in a freefall since the past week.

NSE data showed turnover of ETCDs on Monday stood at Rs 9,064.83 crore compared with Rs 39,063.69 crore on April 4.

Volumes were at Rs 73,173.68 crore on April 3 and Rs 1,00,915.86 crore on April 2.

Delivering the keynote address at a conference of Indian money market and derivatives players in Barcelona on Monday, Das said that while the participation of Indian banks in global markets is growing, it is quite small.

“Domestic banks are dealing with market-makers in global markets rather than with end clients and are yet to emerge as market-makers of note globally. Of course, banks need to do their own due diligence, assess their risk appetite, and then move forward carefully in this direction,” Das said.

“Going forward, our focus should be on enhancing and widening the participation of Indian players in markets for rupee derivatives, both domestically and offshore, while being prudent.’’

A market maker is a participant who by giving buy and sell orders increases the liquidity of the market. After receiving an order, the entity sells from its own holdings. Since the firm is allowed to give two-way quotes, the difference or the spread is its profit.

Back home, his comments come amid falling volumes in the exchange traded currency derivatives (ETCD) market: the RBI has told the market players that they should be in a position to disclose their underlying exposures in foreign exchange from April 5.

Though the deadline has been extended to May 3, market participants remain scared enough to stay away from the market as is evident from the shrinking volumes.

Speaking to newspersons at the post-monetary policy press conference last Friday, the RBI top brass reiterated there has been no change in its policy on ETCDs.

Deputy-governor Michael Patra said Fema regulations have clearly stated that ETCDs are created solely for hedging purposes, and they should thereby have an underlying exposure.

Commenting on the initiatives taken by the RBI to support the financial markets, Das said the recent reforms of the central bank are aimed at providing a strong bedrock for markets to move to the next trajectory to meet the funding requirements in the economy, provide cost-effective hedging options and compete effectively in global markets.

There are, however, some areas which call for attention: transparency in pricing remains a work in progress and more can be done.

“The retail customer is yet to get a deal on a par with large customers. There is a need for effective market-making and finer pricing for smaller deals on NDS-OM,” he said. NDS-OM is a screen-based electronic anonymous order matching system for secondary market trading in government securities.

Divergence in pricing in forex markets for small and large customers is wider than what can be justified by operational considerations, Das said, and added that banks may need to do more to facilitate the use of the FX Retail platform.

He also warned about unauthorised forex trading platforms. “We continue to see banking channels being used by certain persons or entities to fund activities on unauthorised FX trading platforms. This warrants enhanced vigilance by the banks,” the governor said.