Seeking to facilitate a higher credit flow of individual housing loans, the RBI on Friday extended the rationalised home loan norms by another year till March 31, 2023.

In October 2020, the Reserve Bank as a countercyclical measure to deal with the COVID situation had rationalised the risk weights by linking them only with Loan to Value (LTV) ratios for all new housing loans sanctioned up to March 31, 2022.

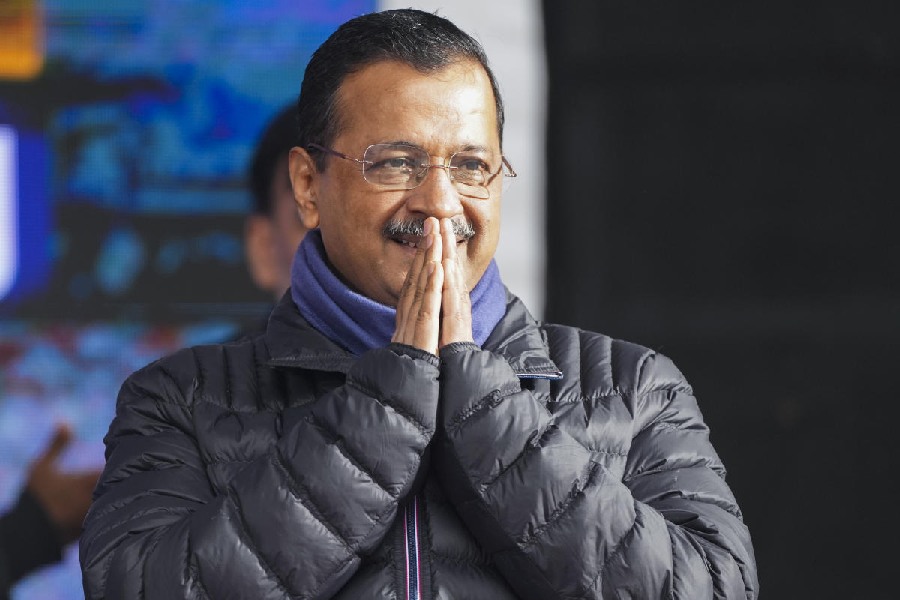

Unveiling the first bi-monthly monetary policy of the current fiscal, RBI Governor Shaktikanta Das said the risk weights for individual housing loans were rationalised by linking them only with LTV ratios for all new housing loans sanctioned up to March 31, 2022.

Recognising the importance of the housing sector and its multiplier effects, it has been decided to extend the applicability of these guidelines till March 31, 2023, he said.

"This will facilitate higher credit flow for individual housing loans," Das said.

Such loans will continue to attract a risk weight of 35 per cent where LTV is less than or equal to 80 per cent, and a risk weight of 50 per cent where LTV is more than 80 per cent but less than or equal to 90 per cent.

The requirement of standard asset provision of 0.25 per cent will also continue to apply to all such loans.

Commenting on the RBI's decision, Dhruv Agarwala, Group CEO, Housing.com, Makaan.com and PropTiger.com, said that despite inflationary pressures increasing, the RBI MPC has continued with its supportive approach to the economy and maintained a status quo on key lending rates.

"By extending the applicability of LTV ratio till March 31, 2023, which will facilitate higher credit flow for individual housing loans, the RBI has recognised the importance of the housing sector and its multiplier effects on the economy," he said.

Agarwala further said sales numbers indicate that India's real estate sector is steadily marching towards more sustained recovery and support policies like these will help that further.

V Swaminathan, the CEO of Andromeda and Apnapaisa, said the extension of the rationalised risk weightage norms for individual home loans will boost participation in this sector.

Housing sales have increased sharply during the last year after a major setback in 2020 when demand plunged by almost 50 per cent due to the COVID pandemic.

Historical low-interest rate is also one of the major reasons driving the sale of residential properties.