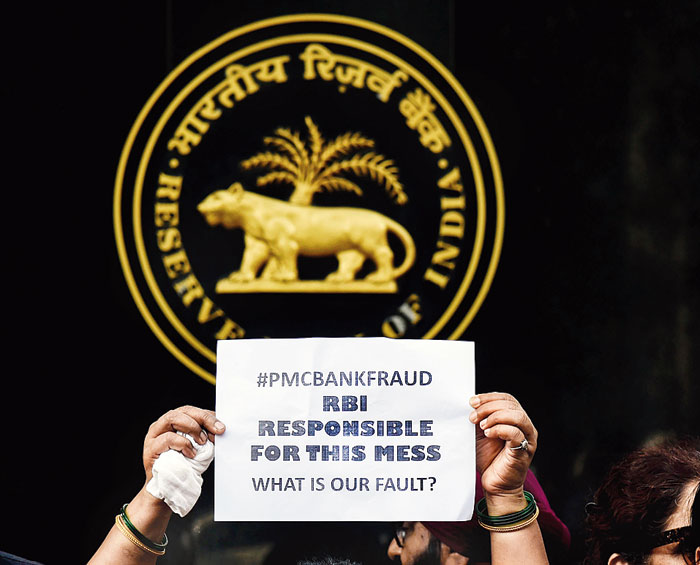

The central board of the RBI on Friday discussed in detail the regulatory and supervisory architecture of commercial and co-operative banks against the backdrop of the Rs 4,500-crore scam at the PMC Bank.

The meeting of the central board, held in Chandigarh, came a day after finance minister Nirmala Sitharaman announced the setting up of a panel to recommend legislative changes to ensure better governance at the co-operative banks.

Besides, the board reviewed the current economic situation, global as well as domestic challenges, and various areas of operations of the Reserve Bank of India (RBI).

Concerns over the economy deepened with the industry growth contracting in August and passenger vehicle sales falling for 11 months running in September.

For the first time this fiscal, bank credit growth slowed to a single digit, printing in at a low 8.79 per cent at Rs 97.71 lakh crore in the fortnight to September 27, according the latest data from the RBI.

“In this context, the board also discussed in detail the current state of the financial sector with special focus on the regulatory and supervisory architecture of commercial and cooperative banks as also NBFCs,” the central bank said in a statement.

The NBFC sector has been facing liquidity woes and other headwinds for many months following the IL&FS fiasco last year.

The board, chaired by RBI governor Shaktikanta Das, also discussed the role of payments banks and small finance banks in enhancing financial inclusion.

The annual activity reports of local boards, various sub-committees of the board and functioning of a few central office departments were also deliberated upon at the meeting.

A strategy sub-committee of the central board of directors has been formed, the statement said.

RBI deputy governors N.S. Vishwanathan, B.P. Kanungo and Mahesh Kumar Jain attended the meeting.