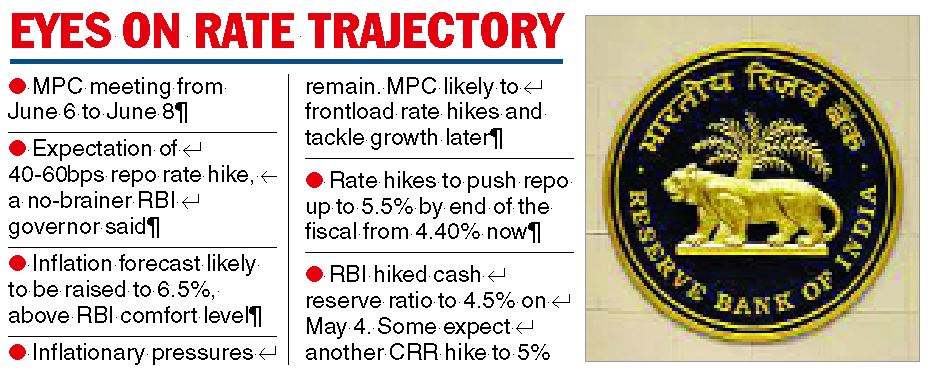

Economists are pencilling in a 40-50 basis point hike in the policy repo rate by the Reserve Bank of India (RBI) as it frontloads interest rate increases to tame elevated inflation. The monetary policy committee (MPC) of the RBI are meeting this week from June 6 to June 8.

A fortnight ago, RBI governor Shaktikanta Das said a rate hike was a “no-brainer’’ action. The focus will be on the RBI’s inflation and growth projections for 2022-23 and indications on the terminal repo rate.

Given the recent resurgence on crude oil price, firm vegetable prices and rising input costs, experts feel the MPC will revise the inflation forecast up to 6.5 per cent for this fiscal from the forecast of 5.7 per cent in April.

In an off-cycle meeting last month, the MPC had raised the repo rate by 40 basis points to 4.40 per cent and the cash reserve ratio (CRR) by half a percentage point to 4.50 per cent.

But inflationary pressures have showed no signs of abating with crude oil prices rising to around $119 per barrel. Crude is expected to remain firm because of tight global supplies and higher demand from China as it eases Covid-19 restrictions.

Though there were some good news in the monsoon arriving early and the government taking fiscal measures, food prices are expected to pose a challenge to policy makers with a spike in tomato prices likely to push inflation higher in May.

Economists feel the RBI will look to frontload interest rate hikes so that inflation is brought under control, giving it space to address growth later.

They said the central bank will first look to raise the repo rate to the pre-pandemic level of 5.15 per cent by August and wait for how inflation pans out to take its next call.

Opinions differ on the terminal repo rate: while some expect the repo rate to land at 5.50 per cent by the end of this fiscal, if inflation continues to be over 6 per cent, others are more hawkish.

“We expect the RBI to hike repo rate by 40 basis points in the June policy meeting. However, we should be open for a rate hike between 35 basis points and 50 basis points hinging on how the MPC wants to reach the pre-pandemic repo rate of 5.15 per cent or around that mark by the end of the August policy,” Suvodeep Rakshit, senior economist at Kotak Institutional Equities, said.

“Along with the repo rate hike, the RBI will revise its inflation estimates higher, possibly indicating inflation remaining close to 7 per cent for most part of calendar year 2022. We expect the RBI to continue focusing on taking inflation and signalling its intent to continue raising rate and normalising liquidity, while not entirely losing its focus on growth given the uneven nature of growth recovery.’’

According to a Bofa Securities note, the MPC will hike the policy repo rate by 40 basis points on June 8 and follow it up with a 35 basis points increase in August. It is also not ruling out the possibility of a combination of 50bps this week and 25bps in August to take the policy repo rate to the pre-pandemic level of 5.15 per cent.

Bofa said if inflation remains high, the RBI will take the repo rate to 5.65 per cent by the end of 2022-23.

Though the RBI had raised CRR by 50 basis points in May, views differ on whether it will again take a similar step. Some economists are betting on another 50bps hike to normalise liquidity conditions, while others expect a pause or a relatively lower hike.

“While the market is still concerned about the concept of withdrawal of accommodation in terms of liquidity, the RBI’s stance has been clear. This has already commenced albeit gradually through various measures taken to not provide excess liquidity (GSAP) and orderly withdrawal of the same. While a further CRR hike can be on the cards, this may not be invoked at this point of time,’’ Madan Sabnavis, chief economist, Bank of Baroda, said.

As per RBI data, the net durable liquidity in the system has come down from a surplus of Rs 8.74 lakh crore in early April to Rs 6.81 lakh crore as of June 2.