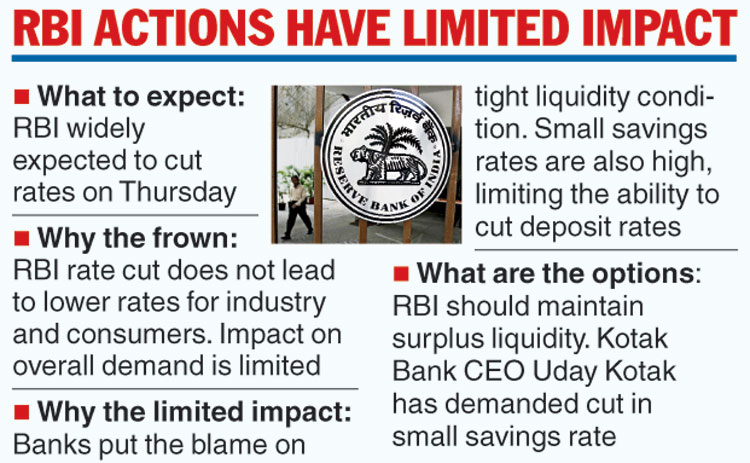

The Reserve Bank is widely expected to cut its policy repo rate on Thursday, but there are grave doubts whether the full benefit of the rate cuts will reach industry and consumers and help to push up the growth rate, which has hit a five-year low. The repo rate is the rate at which banks borrow from the RBI.

The monetary policy committee of the RBI has cut the repo rate by 50 basis this year, but banks have brought down their lending rates by 5-10 basis points.

Analysts said the poor transmission of rates was a major challenge before RBI governor Shaktikanta Das. The RBI, previously, had used various benchmark rates to price bank loans such as BPLR, base rate and MCLR, with limited impact.

A move to link bank floating loans to an external benchmark has been delayed, with the RBI seeking more consultations on this.

Banks have put the blame on the tight liquidity conditions for their inability to reduce their deposit rates, which leads to lower lending rates.

Besides, a large portion of their deposits are held as fixed deposits where the interest rate cannot be reduced frequently. A cut in the repo rate only lowers their incremental cost of funds, but the overall cost does not come down because of the presence of fixed deposits.

The Telegraph

Bank have also cited the competition from small savings schemes that offer higher return and constrain them from cutting their rates.

Some feel that the RBI should maintain surplus liquidity conditions to bring about effective monetary policy transmission.

“There are lots of reasons why transmission has been difficult in our country. For instance, all the small savings rates are relatively high. When they are high, to expect that banks will bring down deposit rates is difficult,” Ananth Narayan, professor at S.P. Jain Institute of Management and Research told The Telegraph.

“But one positive thing that could happen is that the RBI may allow liquidity to go in surplus. Since 2010-11, the RBI has kept banking liquidity tight,” Jain said.

An India Ratings note blamed the poor transmission mechanism on the slowdown in household savings, increased government borrowing and an elevated small savings rate that have rendered deposit and investment mobilisation by the lenders expensive.

The note said consumption demand in India was not financed through credit as personal loan data show. The data excludes home loans.

“More than the rate cut it is the transmission of the rate cut into the economy that has emerged as a bigger challenge. It is well known that the impact of the monetary policy on the Indian economy is felt with a significant lag, but the situation at the current juncture has become further complicated due to the ongoing crisis in both – the banking and the shadow banking sectors,” the Icra note said.

It said that though a rate cut on Thursday was almost a certainty, it was unlikely to stimulate demand in the near- term because of the absence of a “quick resonance” in the financial market.