The Telegraph

Experts are divided over the impact of Tuesday’s Supreme Court judgment on banks even as the RBI is expected to come up with revised norms on the restructuring of stressed assets.

The apex court had on Tuesday quashed the RBI’s February 12 circular, which had set the rules to recognise defaults by large corporates.

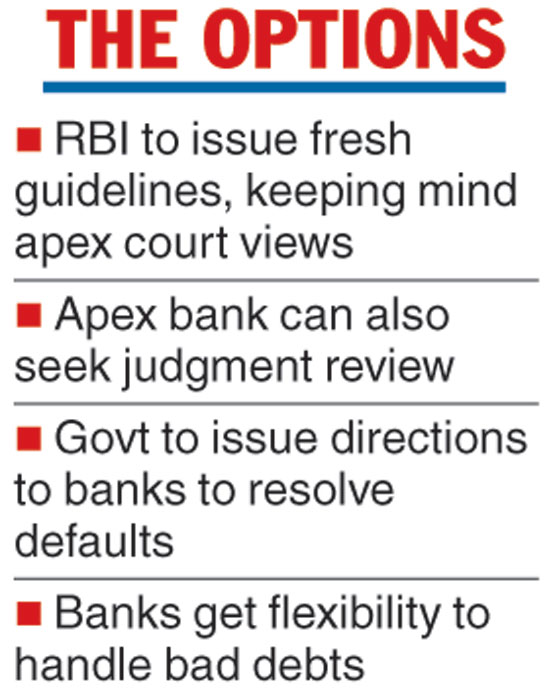

The RBI has the option to either seek a review of the judgment or frame new guidelines. Observers feel the regulator may choose to draw up a fresh set of guidelines keeping in mind the observations of the apex court, particularly on taking a stressed account to the National Company Law Tribunal (NCLT).

A finance ministry source said the government could issue directions to state-run banks to resolve corporate default cases and ensure there was no tampering with the pace of cleaning up bad debt.

“The order does not question the power of government to give directions to banks,” said the government official, who requested anonymity.

“The RBI may have to issue revised guidelines/circulars for the restructuring of stressed assets keeping in view the observations of the Supreme Court. With the threat of IBC proceedings mitigated, it will give some breathing space to power companies as well as flexibility to lenders to restructure debts in a manner which ensures continuity and value maximisation,” law firm J. Sagar Associates said.

According to Crisil, the order will provide the banking system more flexibility and time to resolve stressed assets.

The rating agency pointed out the current timeline for resolution was stringent in the context of the processes the banks had to follow. Another benefit could accrue in the form of lower loss on such loans.

Opposite views

Brokerages are also divided over the impact on banks. Jefferies said the judgment was a big setback as the RBI will not be able to direct “generic insolvency” proceedings.

Japanese brokerage Nomura said while the banks will now have increased flexibility in finding a resolution, the order will “provide the borrowers with some leeway again to delay the resolution process”.