The Securities and Exchange Board of India (Sebi) on Friday proposed foreign portfolio investors (FPIs) be allowed to participate in the country’s commodity derivatives market.

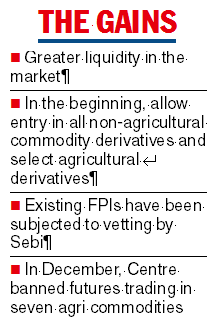

The beneficial move will increase the liquidity in the commodity derivatives segment but it betrays an inconsistent approach to policymaking towards this critical sector.

A little over two months ago, the Centre had banned futures trading in seven agri commodities for a year to control inflation.

They included wheat, paddy (non-basmati), mustard seeds, chana and its derivatives, crude palm oil, moong and soya bean.

A derivatives contract provides the right to exchange a commodity at a later date for a specified price.

Sebi began to regulate the commodities markets from 2015 after the merger of the Forward Markets Commission (FMC) with itself.

The regulator in a phased manner allowed institutional investors in this market — permitting category III Alternate Investment Funds (AIF), portfolio management service (PMS) players, mutual funds and foreign participants having a direct exposure to the physical commodity markets known as eligible foreign entities (EFEs). A review became necessary due to the weak response from EFEs.

In a discussion paper, the regulator said FPIs have been barred from exchange-traded commodity derivatives (ETCD) inspite of their deep pockets.

Sebi said its commodity derivatives advisory committee (CDAC), in its meeting held in November 2021, had recommended the participation of FPIs in exchange traded commodity derivatives.

The discussion paper said even if just a tenth of the 10,000 FPIs registered in the country participate in commodity derivatives, there will be significant liquidity.

Besides, the registered FPIs are subject to adequate safeguards in the form of regulatory supervision or control and their participation may help to bring down the transaction costs in the commodity futures segment, owing to economies of scale.

“Considering that the norms for EFEs have not been effective to gain traction and no EFE has so far evinced interest to participate in ETCDs in India, there is now, a felt necessity, to permit FPIs registered with Sebi to participate in ETCDs in India,” the regulator noted.

The regulator suggested that to begin with FPIs should be allowed to trade in all non-agricultural commodity derivatives and a few selected broad agricultural commodity derivatives. Sebi in consultation with exchanges may work out the modalities including positions limits and other regulatory checks and balances.