Ahead of the expected policy rate hike by the RBI, the government on Friday raised the interest rates on most post office savings plans by up to 0.7 per cent points for the April-June quarter.

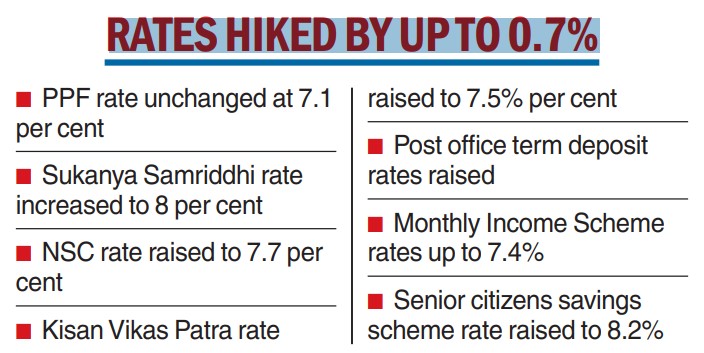

However, the interest rate on the public provident fund has been retained at 7.1 per cent and post office savings deposit at 4 per cent.

“There has been an increase between 0.1 per cent and 0.7 per cent in other saving schemes,” a finance ministry statement said.

Aditi Nayar, chief economist, Icra, said “as expected, small savings interest rates have been hiked by 10-70 bps across various instruments. This should help to garner steady deposits in the coming quarter, in light of the expected rate hike from the MPC (monetary policy committee of the RBI) in April 2023, which would subsequently get transmitted to bank deposit rates”.

The highest increase was in the interest rate of the National Savings Certificate (NSC), which will now attract 7.7 per cent up from 7 per cent for the April 1 to June 30, 2023 period.

The rate for the girl child savings scheme Sukanya Samriddhi has been increased to 8 per cent from 7.6 per cent.

The interest rate on the senior citizen savings scheme has been raised to 8.2 per cent from 8 per cent and Kisan Vikas Patra to 7.5 per cent from 7.2 per cent. KVP will now mature in 115 months against 120 months earlier. The rates, notified quarterly, were also raised in the last quarter.

With the revision, a one-year term deposit with post offices would earn 6.8 per cent up from 6.6 per cent; a two-year deposit would fetch 7 per cent up from 6.9 per cent and five years, 7.5 per cent against 7 per cent, previously.

The interest rate on Public Provident Fund (PPF) has been retained at 7.1 per cent and that of the savings deposit at 4 per cent. The monthly income scheme has been increased 30 basis points to 7.4 per cent.

The small savings rates, while set by the government, are linked to market yields on government securities at a spread of 0-100 basis points over the yield of these securities of comparable maturities.