Provident fund and income tax data are helping employers to track cases of moonlighting by their staff.

In an interaction with The Telegraph, Ajay Trehan, founder and CEO of Authbridge, an identity verification company, said there has been a sudden surge of interest among large employers across IT and FMCG industries to check whether their employees are engaged in a second job after regular hours with the company, to the extent that the matter has become a boardroom issue.

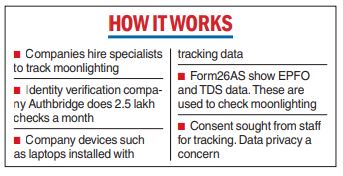

“About six months back, we were not doing these checks and now we are doing about 2,50,000 checks a month. It is across sectors including large FMCG organisations, large IT/ITeS companies. We have close to 1,800 customers. There are about 35 customers for whom we do moonlighting checks. There are at least about 100 who are evaluating whether they want to do it,” said Trehan.

He added that the algorithms available today is allowing service providers to check en masse the employee data and report it to the employers. Among the employers, the reaction has been a mixed bag ranging from a more sympathetic view to terming moonlighting as cheating.

Besides the conventional checks where most large organisations have installed applications on devices given to employees such as laptops to monitor basic usage, available financial data such as EPFO deposits and tax deduction at source reflected in Form 26AS could be utilised to check for dual employment.

“Employers can check the status of the provident fund and whether the employee is receiving contributions from more than one company. The employee may not be directly employed with another company but may be getting a consultancy fee paid for something that he is doing for them after office hours. The firm while paying the fee will be deducting TDS. That will reflectin 26AS,” said Trehan.

Consent, data privacy

A large part of these checks are consent driven and in some organisations employee simpart these through authorisations at the time of joining. “My view on the matter is if the employee has nothing to hide, and is adhering to the regulations laid by the organisation, he should have no issue in sharing some of that information,” said Trehan.

A key concern among employees is privacy and the end use of the data. Trehan said that service providers such as Authbridge ensure that employee data is kept private.