The private sector in India bore the brunt of the income losses in 2020 when the pandemic first broke out because the Modi government shrank from its obligation to come up with a credible fiscal support programme to guide the country out of the crisis.

The private players will have to bear the burden of paying the cost for igniting an economic recovery this year as well as the government continues to sit on its haunches and counts up the pennies it saved by resisting a clamour for funds to jump start a moribund economy.

A Motilal Oswal study pulls no punches in its withering analysis of the government’s ham-handed, twiddly-thumbed effort to assess and deal with the crisis — and makes a dire forecast for the current year during which an unequal burden sharing of costs by the private sector could make the economic recovery that much more difficult and flaky.

It is arguably the first serious attempt by any brokerage in the country to examine how the crisis impacted income and savings across sectors and seeks to call a spade a spade by squarely apportioning blame where it deserves to be laid, abandoning a culture within the brokerage community of delivering unctuous, mealy-mouthed drivel to investors throughout the painful crisis.

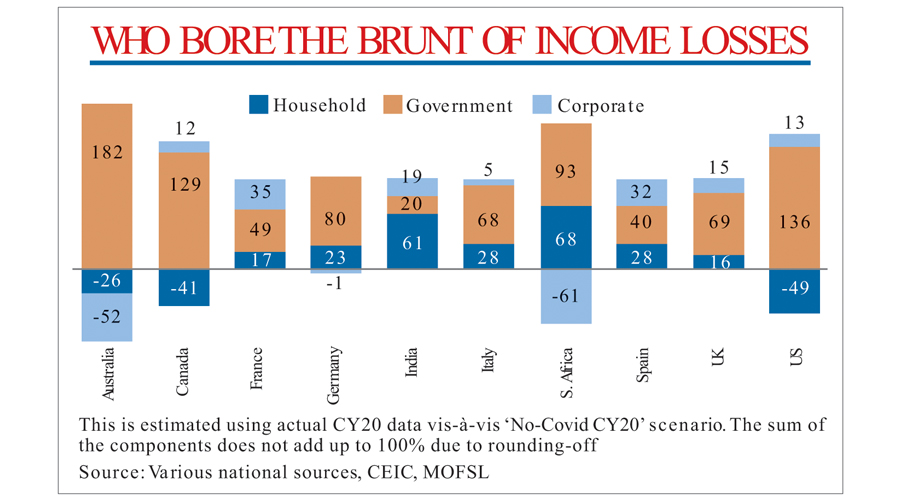

The study, which develops its own methodology to make its assessment in the absence of income and savings data by sectors on a regular basis, estimates that almost four-fifth of all income losses in calendar year 2020 were incurred by the private sector which is represented by the household and corporate sectors.

In contrast, the Indian government assumed only 20 per cent of all income losses largely as a result of the limited fiscal stimulus it provided when the pandemic first engulfed the nation.

The study makes an unflattering comparison with how other nations responded to the crisis.

It reveals that countries such as Australia assumed 200 per cent of the nation’s income loss, while Canada and the US took on board 100 per cent each as they shovelled funds to the private sector.

Even in Europe, the income loss suffered by the private sector ranged between 20 and 60 per cent. South Africa — the only emerging economy included in the study — came up with a robust fiscal stimulus and compensated almost the entire private income loss in CY20, the study adds.

The study found that “due to extremely low fiscal support in India, the income losses for the private sector (especially households) were much higher compared to other major nations”.

Recovery doubts

It then goes on to make a disturbing forecast about the pace of economic recovery in India at a time when a number of international and domestic agencies have started to furiously back pedal on their growth projections for 2021-22.

The study says: “Going forward, as the government sector in all countries, including India, will be taking a step back ....as Covid-19 subsides, the burden of stronger growth will fall entirely on the private sector.”

It ominously adds: “With India’s private sector bearing such a large share of income losses in we are sceptical of a strong rebound in growth, as and when it happens.”

The Motilal Oswal report, prepared by research analysts Nikhil Gupta and Yaswi Agarwal, says that the study throws up an important nugget that the Modi government needs to chew on.

“With India witnessing a much ferocious second Covid wave, the major lesson for the government is to loosen its purse strings and support the household sector directly via income transfer/employment guarantee. Without a strong household sector, the Indian economy may find it difficult to achieve a strong revival on a durable basis in a post-Covid era,” it said.

The study comes with a caveat: it had to devise a specific methodology to estimate the extent of the income loss in India.

Traditionally, there are two ways in which the income loss can be computed: either the national statistical agencies publish the gross disposable income (GDI) on a regular basis, or the government releases sectoral data on gross savings which can then be added to consumption spending to arrive at GDI.

In the case of almost all the advanced economies, both sets of data were available. But in the case of India, "neither income nor savings data by sectors is available on a regular basis." The Central Statistics Office publishes sectoral income and savings data only on an annual basis and that too with a lag of 10 months. The data for fiscal year 2021 will only be available at the end of January 2022.

The study admits that its estimates may not exactly match the official data whenever that becomes available. "However, we believe that the broad trends and conclusions are likely to stay intact," the researchers asserted.